2025年のFPD業界を予測する~注目ポイント9選 ※1/16改訂

これらCounterpoint Research FPD部門 (旧DSCC) 発の分析記事をいち早く無料配信するメールマガジンにぜひご登録ください。ご登録者様ならではの優先特典もご用意しています。【簡単ご登録は こちらから 】

2025年のFPD業界を予測する~注目ポイント9選

2019年から年初の恒例となっているが、今年も今後1年間のFPD業界を予測する注目ポイントを紹介していこう。

#1:TV用LCD価格は上昇

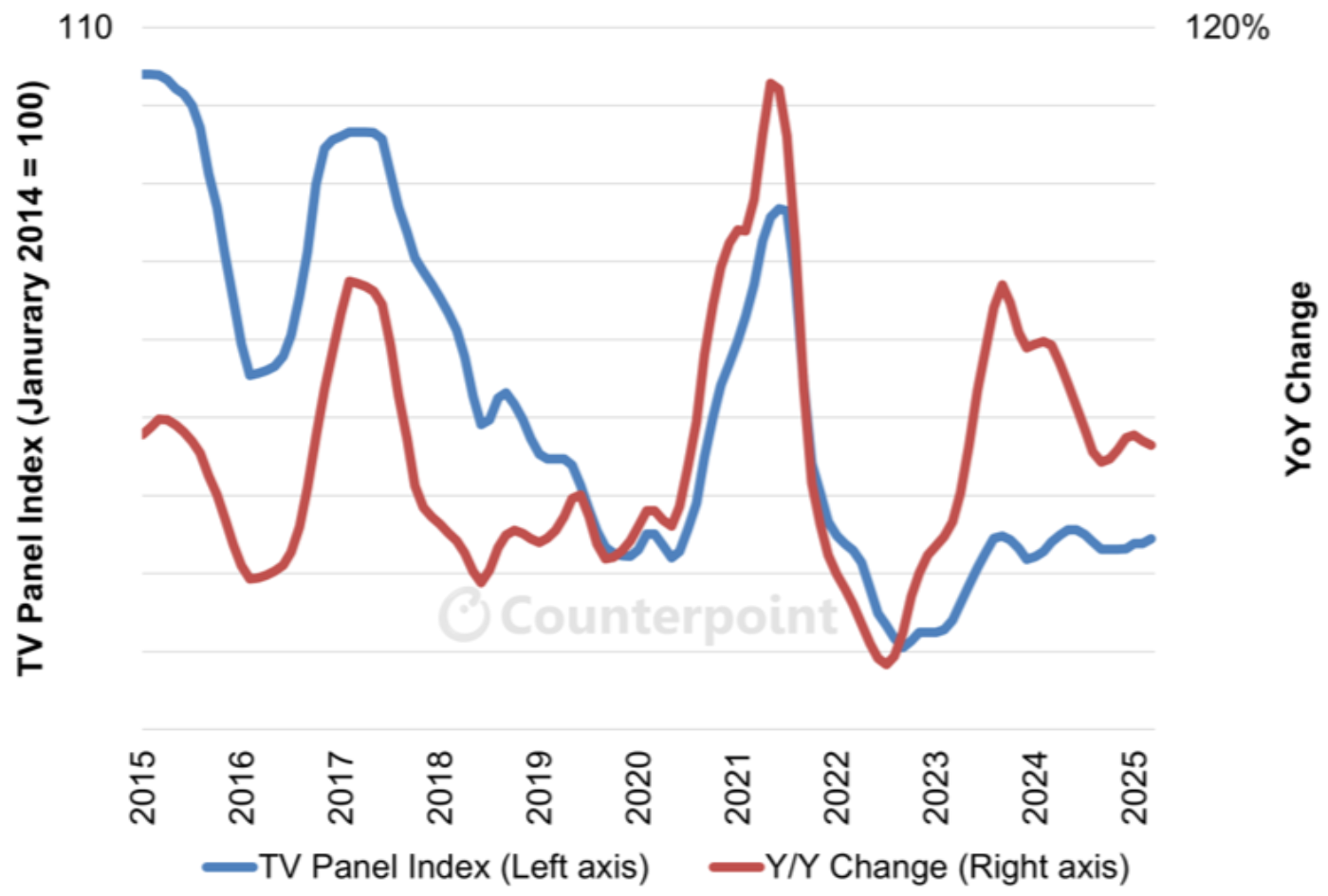

Counterpoint ResearchのTV用LCD価格指数は、供給不足と供給過剰を含む「クリスタルサイクル」を明らかにするもので、FPD業界の健全性を示すおそらく最も重要な指標のひとつである。

パンデミックの後、供給が不足から過剰に転じたことでLCD価格は暴落、LCDメーカーは在庫売却による現金調達のためキャッシュコストを下回る価格で販売し価格は2022年9月に過去最低値を記録した。価格は価格はQ2’23とQ3’23に2桁%上昇した後、Q4’23以降は5四半期にわたり小幅な上昇と下落を繰り返しながらきわめて安定した状態が続いている。さらに、2024年9月から11月にかけては、中国に集中するLCDメーカーが需要に合わせて稼働率を引き下げたため、価格が変動しない状況が続く異例の事態となった。

この価格安定期に需給状況は徐々にLCDメーカーにとって有利な方向に改善した。Sharpの第10世代堺工場閉鎖を筆頭に、生産ライン閉鎖によってLCD業界の生産能力は縮小した。同時に、画面サイズの大型化にともなってTV面積需要も増加、このトレンドは2024年になって強まり、主要中国ブランドが積極的に推進する超大型 (85インチ以上) LCD TVの成長率は3桁%に達した。

供給減と需要増が重なり、業界は供給過多から均衡へと向かっており、TV価格が上昇するシーズンが1年のうちに少なくとも1回、場合によっては複数回あるかもしれないと予測している。第1四半期は価格上昇の見通しとなっており、この予測は2025年の早期に実証される可能性がある。

#2:燐光青色発光体採用のOLED製品は販売されない

当社は2024年もこの予測を提示したが、2025年も同様だというのが当社の見解だ。

OLEDファンは改良版青色OLED発光体を10年以上待ち望んできたが、燐光青色発光体搭載製品を目にするには、少なくともあと1年は待たなければならないだろう。

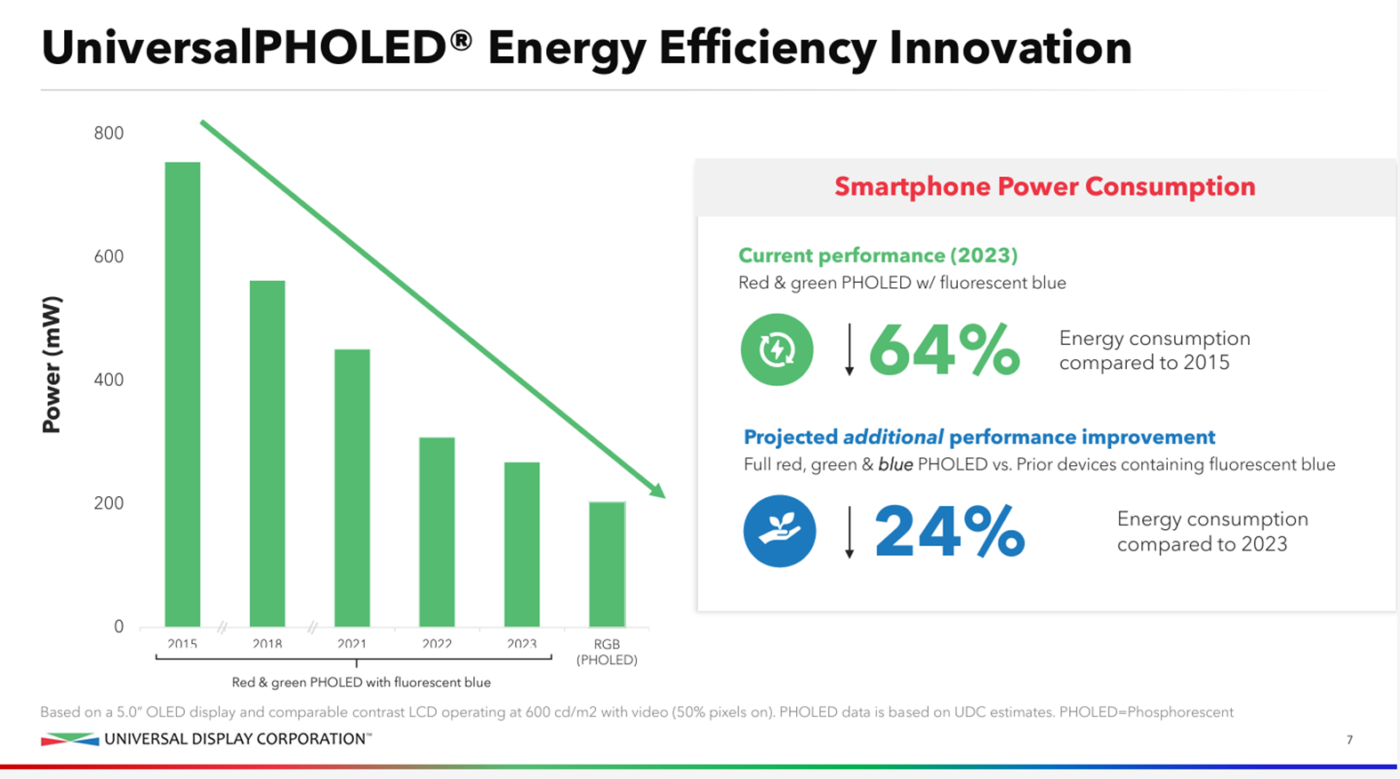

高効率青色OLED発光体はOLED業界全体、とりわけその開発企業にとって非常に大きな後押しとなるだろう。Universal Display Corporation (UDC) の赤色および緑色発光材料では、先行技術である蛍光で内部量子効率が25%であるのに対し、燐光では100%の内部量子効率が可能になり、高効率で優れた色と寿命を実現する。高効率青色はOLED分野のあらゆる製品アーキテクチャにコストと性能のメリットをもたらすだろう。モバイル用RGB OLEDについてUDCでは、燐光青色発光体を採用したディスプレイは2023年時点のディスプレイと比べ、消費電力を24%削減可能と予測している。

UDCは燐光青色発光体の開発に長年取り組んできた。2022年2月、同社はついに、同年末までに商業的な目標スペックを達成し2024年に燐光青色発光材料の販売を開始する見込みであることを発表した。UDCは2024年中盤までその予定を維持してきたが、その後、商業化が「数ヵ月」遅れていることを発表した。

当社の情報源によれば、燐光青色は商業製品の寿命テスト要件に合格できない状況が続いているという。最新情報によると、燐光青色発光体の寿命は量産材料と比べ40-50%にすぎない。燐光青色の最初の導入は、蛍光発光材料と組み合わせたタンデム構造になる可能性がある。

その時がいつになるにせよ、燐光青色発光体の導入はLCDとの競争においてOLED技術に弾みをつけるものになるだろう。燐光青色発光体を搭載したディスプレイがいずれ市場に登場するのは間違いないが、それは2025年ではないだろう。

#3:インドでFPD生産能力増強が進む

2024年はこの予測が誤っていたが、インドにおけるFPD生産の必然性はかつてないほど強いことから、2025年もこの予測を繰り返したい。2025年末までに結果が確実にわかるとは限らないため、事実上これは予言 (あるいは予測と言ってもいいが) についての予言である。

21世紀の最初の20年間、インドにFPD工場を建設するという議論は何度か持ち上がった。近年はVedantaがインドにおけるFPDのチャンピオンとして浮上している。Vedantaは2017年に買収したガラスメーカーAvanstrateの所有という形ですでにFPD業界に参入している。インドのコングロマリットであるVedantaは2023年初めに、Innoluxと技術ライセンス契約も締結している。1年前、当社はVedantaが2026年に第8.5世代a-Si LCD生産ラインで量産を開始すると予測していたが、現在の見通しでは2027年第4四半期まで先送りとなりそうだ。

FPD生産能力に関する当社の最新の見通しでは、Vedantaの2028年の生産能力は420万平方メートルで業界全体の生産能力の1%弱になる予測である。2025年にはさらなる拡張が発表・計画され、2025年末には当社の生産能力予測モデルで2029年生産能力が420万平方メートル以上になると考えられる。

インドでのFPD生産が必然である理由は以下の通りで、その説得力は1年前よりもさらに強くなっている。

- インド政府が半導体とFPDに対する大規模な補助金制度を発表した。中央政府が承認済みFPD生産能力投資額の50%を補助し、州政府および地方政府機関からは20%の補助が受けられる可能性がある。

- 米中間の地政学的関係が非常に悪化している。バイデン政権は中国に友好的とは言い難かったが、次期トランプ政権はさらに敵対的になる可能性が高い。

- 中国がFPD業界、特にLCD業界を支配している。2016年、中国は世界のLCD生産能力の30%に過ぎなかったが、2025年には世界のFPD生産能力の73%、LCD生産能力の76%を占めるようになる。

- 中国の経済成長が鈍化する一方、インドは2020年代に最も急速な経済成長を遂げている国である。

- 中国の人口がピークを迎えて減少している一方、インドの若年人口は増え続けており、今や世界で最も人口の多い国となっている。

- インドの国内TV市場は、中国、米国に次いで世界第3位の規模を誇るが、中国や米国とは異なり、インド市場は成長を続けている。インドTV市場は2030年には3000万台に成長、その後もさらに成長すると当社は予測している。中国TV市場のピークは2018年の5900万台である。

他の多くの国とは異なり、インドには相当規模のFPD産業を支えるに十分な経済規模と市場がある。インドの2024年のFPD製品全用途の最終市場需要は1600万平方メートルで、Vedantaの計画と同規模の工場ほぼ4つに相当すると当社では推測している。また、世界のFPD需要は緩やかな成長が予測されるが、インドのFPD需要は予測期間を通じて2桁%で成長すると考えられる。

#4:MiniLED出荷数はTV用とモニター用で2桁増、自動車用で3桁増に

大画面ディスプレイの最上位クラスにおけるMiniLEDとOLEDの技術競争では、2024年にMiniLEDが優位に立たったが、その勢いは2025年も続くと見られる。Counterpoint Researchの Quarterly Advanced TV Shipment and Forecast Report によると、TV市場では、SamsungのMiniLED TVの出荷数が前年比19%減となったにもかかわらず、MiniLEDの出荷数は2024年第1-3四半期に前年比74%増を記録した。このギャップを埋めたのは、中国ブランドのTCL、Hisense、Xiaomiで、いずれも自国市場と輸出の両方でMiniLEDを積極的に販促した。

TCLはMiniLED技術のパイオニアで、2019年に最初のTV製品を発売した。しかし、2021年にSamsungがMiniLED TVを発売すると、Samsungは一気に急成長して首位に躍り出た。2024年、Samsungは出荷数の低迷によってTCLとHisenseに次ぐ第3位に転落し、Q3’24にはHisenseが首位となった。MiniLED LCD TV情勢は多様化しており13ブランドが参入、直近四半期には5ブランドが10万台以上を出荷した。2025年のMiniLED TV出荷数は17%増の750万台になると予測される。

モニター分野のMiniLED市場はさらに競争が激しく、少なくとも21のブランドが製品を市場に出しており、トップブランドであるAOCのシェアは16%に過ぎない。MiniLEDモニター市場への参入障壁は低く、存在しないといってもよいほどで、この状況は続くと考えられる。2025年のMiniLEDモニター出荷数は前年比40%増の520万台になると予測される。

自動車メーカーの多くがOLEDよりもMiniLEDを支持しているのは、OLED技術の寿命性能に懸念があるからだ。2024年には、Cadillac XT4やCELECTIQ、Krypton ZEEKR 009 Glowなど、大型MiniLEDディスプレイを搭載した自動車が多数発表された。多くのパネルメーカーがこのビジネスで競い合っており、自動車用ディスプレイの出荷数は2024年の450万台から2025年には1000万台以上に増加すると予測されている。

#5:トランプ関税で需要は減退、FPDサプライチェーンは混乱へ

2025年のFPD業界、そして他の多くの業界にとって最大の不確定要素の1つは、間もなく就任するトランプ大統領が米国の貿易相手国に関税を課すという選挙公約を実行に移すかどうか、またどのように実行に移すかということである。2024年の選挙期間中、トランプ氏は中国からの輸入品に60%の関税をかけると約束し、選挙後、同氏は自身のTruth Socialアカウントに、就任初日にメキシコとカナダからの輸入品に25%、中国からの輸入品に10%の関税をかけると投稿し、移民問題とフェンタニル密輸を国家安全保障上の懸念事項として挙げた。

多くのアナリストは、トランプ大統領の発言はより有利な貿易条件の交渉に向けた布石に過ぎないと考えている。2018年にトランプ大統領が署名したUSMCA自由貿易協定は2026年に見直しの時期を迎え、トランプ大統領は変更を要求すると見られている。アナリストたちは、トランプ大統領は2016年の選挙キャンペーンでも関税について大胆な主張を行ったが、そのほとんどは実現しなかったと指摘している。

関税が実現した分野の一つは、中国に対するものだった。トランプ大統領は最初の任期で、中国からの輸入品1500億ドルに関税を課したが、その中にTVは含まれていたが、モニター、ノートPC、スマートフォンは含まれていなかった。この関税は、中国が差別的な貿易慣行を行っているという調査結果を受け、通商法301条に基づいて実施された。

新型コロナウイルスのパンデミックが始まった2020年1月、トランプ大統領が中国の習主席との「歴史的」貿易協定を発表したことで、当初15%だったTV関税は半減した。この協定により、中国は2021年末までに米国輸出品2000億ドルを追加購入するはずだった。パンデミックの混乱は確かに要因ではあったが、結局、輸出増加は実現しなかった。トランプ大統領にとって最も重要な数字である米国の対中貿易赤字は、史上最高だった2018年の4180億ドルから2023年には2790億ドルまで減少したが、その大半は輸入減少によるものだ。

もしトランプ大統領が2025年に中国やメキシコからの輸入品に関税をかけるのなら、FPD業界は確実に影響を受けるだろう。下表に示すように、この2カ国はFPDを搭載した最終市場製品の輸入額の80%を占めている。

関税の正確な影響は、それがどのように実施され、影響を受ける政府や業界関係者がどのように反応するかによる。当社では、その影響には以下のような要因が絡んでくると考えている。

- 米国におけるFPD最終製品の価格上昇

- 価格上昇による米国需要の減少

- 利幅縮小と需要減少による、米国のデバイスメーカーと小売業者の利益減少

- メーカーからサプライヤーへの関税ペナルティ押し付けによる、FPD価格の低下

- ベトナムやマレーシアなど、影響を受けない国への最終製品組み立てのシフト

直近のトランプ大統領の発言では就任初日の関税実施が約束されており、今月末までにはどのような関税が導入されるか明らかになるかもしれない。

#6:知的財産権訴訟がFPDメーカーを制約

関税の脅威に加え、米中貿易戦争におけるもうひとつの側面は、知的財産権 (IP) をめぐる訴訟である。このうち2件の訴訟がFPD業界の一定のサプライヤーにとって大きな障壁となる可能性がある。

そのうち1件については、当社ニュースレターの別記事で紹介している。米国のガラスメーカーであるCorningが米国国際貿易委員会(ITC) に対し、中国のガラスメーカーであるIricoのディスプレイ用ガラスを使用した製品の輸入禁止を申し立てたもので、CorningはIricoがCorningから盗んだ企業秘密を使用しCorningの複数の特許を侵害したと主張している。ITCは2025年初頭に本件の調査を開始すると見られる。

もう1件の訴訟は数年前にさかのぼり、こちらはかなり進んでいる。ITCは2024年11月、BOEが複数のOLED関連の特許を侵害しているというSamsungの主張に対する調査を終了した。行政法審判長 (ALJ) は調査の一環として、337条違反に関する最初の決定を下した。ALJはまた、この調査で最終的に違反が認められた場合の救済に関する勧告も発表した。ALJはさらに、委員会が違反を認定した場合の救済勧告によって提起される公共の利益に関する問題について、提出書類の募集を行った。

これに関連して、米下院の中国共産党特別委員会のJohn Moolenaar委員長はITCに書簡を送り、裁定に従ってBOE Technology Groupの米国への製品輸入を禁止するよう求めた。Moolenaar委員長は9月、米国国防総省に対し、BOEを中国の軍事企業としてリストアップするよう求めていた。

Moolenaar委員長は12月にITCのRhonda Schmidtlein委員長に宛てた書簡で、以下のように記している。「もし委員会がBOEのディスプレイ (米国特許の侵害が明らかに示唆されている) の輸入禁止を拒否すれば、BOEの知的財産の窃盗が中国の軍民融合戦略に利益をもたらす状況が続き、FPD産業におけるBOEの支配力が拡大することで、軍事用途に不可欠な先端技術で米国が中国に過剰に依存する状態が続くことになる。さらに、委員会が中国に対し、中国企業は今後も米国の知的財産を自由に盗んでも良いという危険なメッセージを送ることになる」

第3の訴訟は2024年11月に始まったもので、京都のMaxellが保有する特許をTCLが侵害した疑いに関する訴訟である。ITCは、スマートTVの操作と通信に関する4つの特許について調査を開始した。

これらの訴訟のいずれもが、特許侵害と認められた製品の輸入禁止につながる可能性があり、輸入禁止はFPDサプライチェーンにおけるサプライヤーと顧客の双方に大きな影響を与えるだろう。次期トランプ政権によるWashingtonの政治環境を考慮すると、これら3件の訴訟で中国側の被告が申し立てに異議を唱えようとしても、同情されることはないだろう。

#7:SamsungがスマートARグラスを発売、ただし数量は少ない

2024年AR/VRデバイス市場で最大のニュースは、AppleがVision Proヘッドセットを発表したことだ。このデバイスの評判は、Forbesの記事のタイトル「Apple's Vision Pro Is Amazing But Nobody Wants One (AppleのVision Proは素晴らしいが、誰も欲しがらない) 」にうまく集約されている。このデバイスは素晴らしい評価を得たが、売上は期待外れだった。

Appleが複合現実 (Mixed Reality, MR) ヘッドセット市場を活性化させることができなかったことから、現在は扱いやすいスマートグラスに注目が集まっている。ディスプレイは搭載されていない製品だが、おそらく最も成功したスマートグラスは、MetaとRay-banのコラボレーションによるRay-ban Metaスマートグラスだろう。ディスプレイがないことで製品の機能性は制限されたが、デザインはエレガントで着用しやすかった。Wall Streat Journalに掲載されたMetaのウェアラブル担当バイスプレジデントのコメントは「エスカレーターは壊れず、階段になる、というのと似ている。バッテリーが切れても、美しい眼鏡であることに変わりはない」というものだった。

Metaは2025年にAR (すなわちディスプレイ搭載) スマートグラスを発売し追随すると当社は予測している。この製品は9月にデモを行った先進的なOrionグラスとは異なり、おそらくLCoSをベースにしたものになるだろう。

2025年には、SamsungがARグラスで参戦すると見られる。Samsungはすでに、Googleの新OS、Android XR を搭載したMRヘッドセットを発表している。しかし、このデバイスはAppleのVision Proに対抗するために設計されたもので、すぐに同じ運命をたどる可能性がある。SamsungはMetaと真っ向勝負できるスマートグラスに力を注ぐことになるかもしれない。おそらくAndroid XRが搭載され、これによりGoogleのAIアシスタントを利用できるようになる。Samsungのスマートグラスの数量が20万台を超える可能性は低いと思われるが、第一世代の製品としては成功と言えるかもしれない。

#8:フォルダブル型スマートフォンはニッチ市場のまま成長せず

プラスチック基板で製造されるOLEDディスプレイに対する大きな期待は、フォームファクターの革新を可能にすることである。ガラス基板からポリイミド基板への移行により、ディスプレイはガラスでは不可能な形状に曲げることができるようになった。Samsungはフォルダブル型スマートフォンであるGalaxy Z FoldおよびZ Flipシリーズという形で、この期待をスマートフォンにもたらす先鞭をつけた。

Samsungはフォルダブル型スマートフォンでこれまでに6世代を経ており、2025年には第7世代の発売が見込まれる。歴代の各世代は、より頑丈なヒンジ設計や折りたたみ時の「しわ」の除去など、初期の設計の問題点をほぼ解決してきた。OPPO、vivo、Xiaomiなど他のブランドもフォルダブル型スマートフォンのデザインを発表しているが、フォルダブル分野でSamsungにとって最も重要な競争相手はHuaweiであり、同社のフォルダブル型スマートフォンであるMate X6とPocket 3はフォルダブル分野におけるHuaweiのシェアを2023年の18%から2024年には33%に押し上げた。

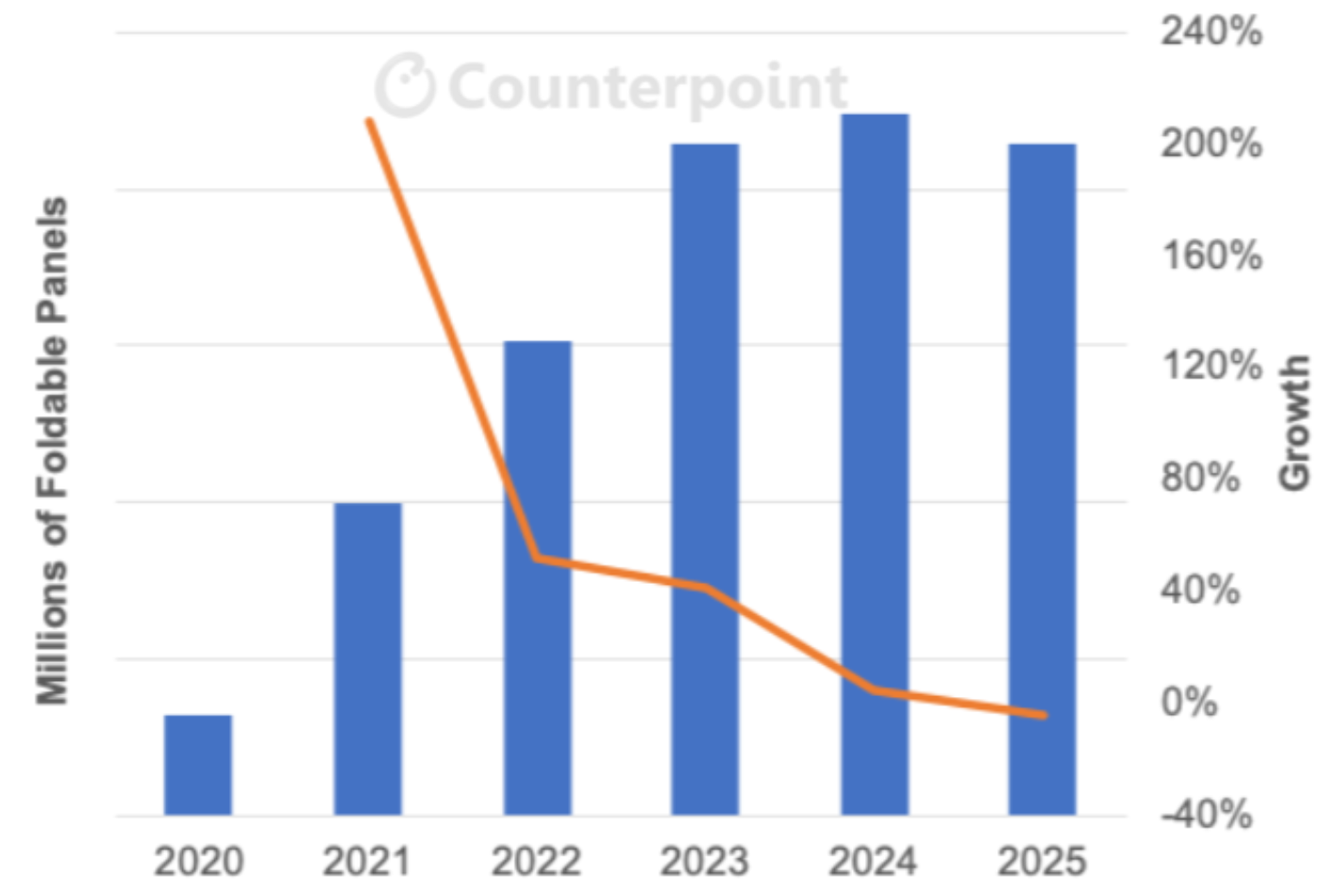

2018年後半に初めて登場したフォルダブル型スマートフォンは2023年まですべての年で力強い成長を記録したが、その成長は2024年に失速し、2025年はさらに悪化の見通しだ。Counterpoint Researchは現在、スマートフォン用フォルダブルパネル市場は2024年には5%増にとどまり、2025年には4%減になると見ている。パネル需要は2200万枚程度で停滞しており、これは数量ベースでスマートフォン市場の1.5%程度に過ぎない。

Samsungではクラムシェル型スマートフォンGalaxy Z Flip 6やフォルダブル旧モデルの採用が予想以上にスローで、2024年のZ Flip 6用パネル出荷数は2023年のZ Flip 5用パネル出荷数を10%以上下回ると予測される。需要が韓国と欧州にかなり集中している状況が続いており、同製品は米国と中国での普及に苦戦している。Huaweiも2024年後半にパネル調達を引き下げた。同社は中国における先進プロセッサ輸入制限によって打撃を受けており、プレミアムスマートフォン市場で不利な立場に置かれている。

フォルダブル型スマートフォンのカテゴリーで大きな期待を集めているのはAppleだが、Appleがフォルダブル型スマートフォンを発売するのは早くても2026年になると見られる。一方、Huaweiは2025年に発売モデルを減らし、他のブランドも旧モデルを縮小すると予想される。出荷モデル数は2024年の41モデルに対し2025年には32モデルになる見込みだ。そのため、5-10年後にはフォルダブル型スマートフォンが再び急成長の可能性もあるが、このカテゴリーは2025年はスマートフォン市場全体のなかのニッチにとどまるだろう。

#9:新規LCD生産能力計画が浮上

2023年と2024年はともにLCD生産能力の停止を予測し、いずれも正しかった。そのため、2025年に新規生産能力を予測するのは奇妙に思えるかもしれないが、LCD需給バランスを取り戻すことを考えれば、今年は誰かが生産能力拡大の計画を始めるのは理にかなっている。

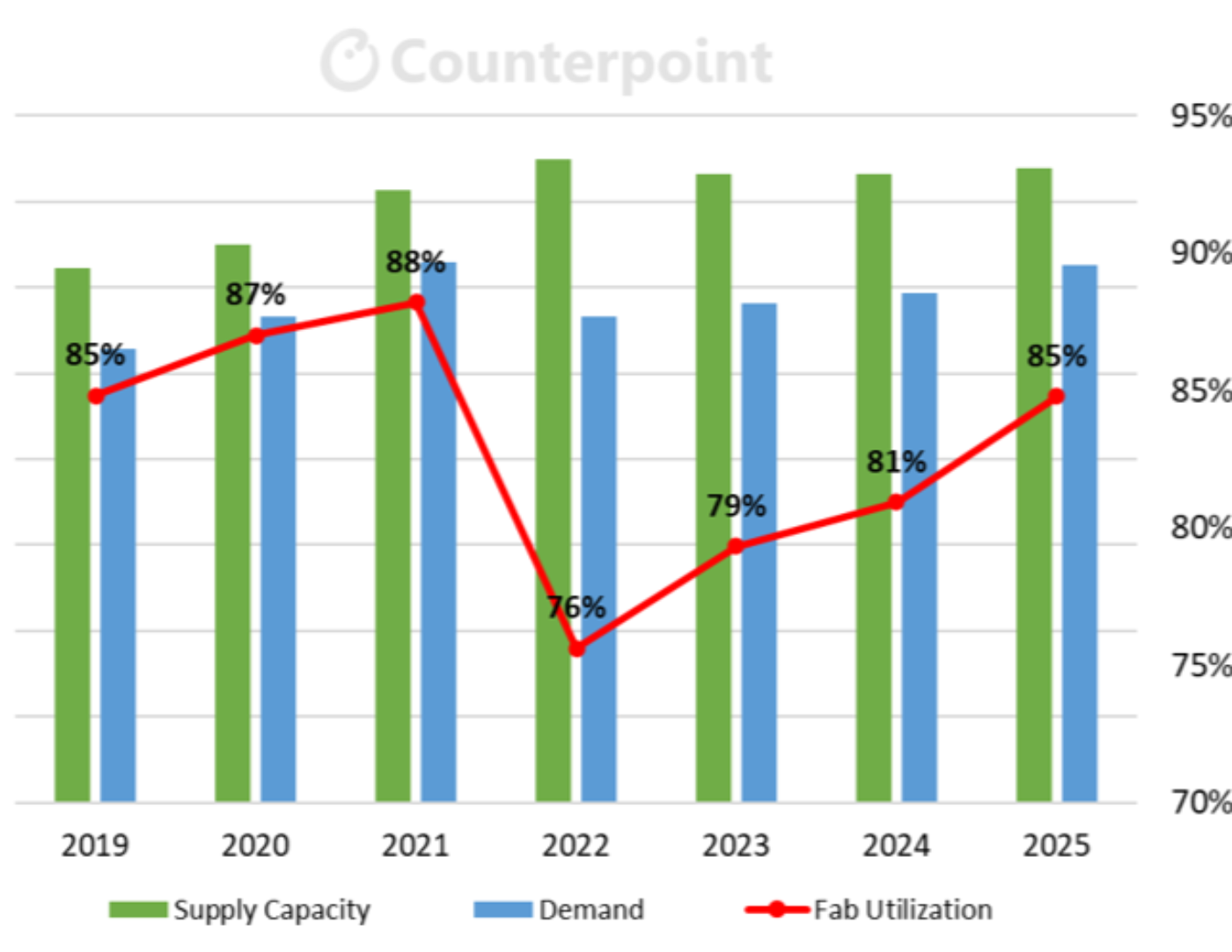

次のグラフに示すように、LCD業界全体の生産能力はこの2年間、需要増加の一方で減少を続けている。2022年の業界の供給過剰は深刻で稼働率は76%にとどまったが、2023年には79%、2024年には81%まで改善した。当社の見通しでは、2025年のLCD生産能力の伸びは1%未満、需要の伸びはおもにLCD TVの画面サイズ拡大により5%程度と予測している。これにより、通年の稼働率は比較的健全な85%に達するだろう。

今年の予測#1で説明したように、TV用LCD価格が上昇しTV用LCDメーカーの収益性は改善すると見られる。今年、大幅な増益を期待するのは非現実的と考えるが、稼働率の改善パターンは業界関係者にとって明らかであろう。LCD生産能力拡大は最小限にとどまっており、2025年の生産能力増は1%未満、2026年は3%未満、2027年はわずか2%の見通しだ。その結果、現在の見通しでは2028年の業界稼働率は88%まで上昇、これは業界史上最も収益性の高かった2021年の稼働率に匹敵する。

1社または複数のLCDメーカーがトレンドを認識し、新たな拡張計画で先手を打つことになると当社は見ている。それは生産能力No.1の座を争っている中国大手のBOEやCSOTかもしれないし、予測#5で述べたようなインドの新規参入企業かもしれない。

これらCounterpoint Research FPD部門 (旧DSCC) 発の分析記事をいち早く無料配信するメールマガジンにぜひご登録ください。ご登録者様ならではの優先特典もご用意しています。【簡単ご登録は こちらから 】

[原文] 9 Predictions for the Display Industry in 2025

As we have done each year since 2019, we have some predictions for the year.

#1: LCD TV Panel Prices Will Increase

Counterpoint Research’s price index for LCD TV panels serves as perhaps the most important dashboard indicator of the health of the flat panel display industry as it illuminates the Crystal Cycle of shortage and oversupply.

In the wake of the pandemic, panel prices crashed as shortage turned to oversupply and prices reached an all-time low in September 2022 with panel makers selling below cash costs to raise cash by selling off inventory. Prices increased by a double-digit % in Q2 2023 and Q3 2023 but have been remarkably stable since Q4 2023 with small increases and decreases for five quarters. Further, prices had an unprecedented streak of no change from September to November 2024 as LCD makers, concentrated in China, throttled back utilization to match demand.

During this period of price stability, the supply-demand situation has gradually improved in favor of panel makers. The industry’s LCD capacity has been reduced by fab closures, most prominently the closure of Sharp’s Sakai City Gen 10 fab. At the same time, TV area demand has increased with the increase in screen size, a trend that continued to be strong in 2024 with triple-digit % growth in ultra-large (85” and larger) LCD TVs aggressively promoted by the major Chinese brands.

The combination of reduced supply and increased demand has pushed the industry from oversupply to balance, and we expect there will be at least one season during the year, and maybe more than one, where TV prices will increase. This prediction might be proven quickly in 2025, as our current outlook is for prices to increase in the first quarter.

#2: No OLED Products with Phosphorescent Blue Emitters Will be Sold

We made this prediction for 2024 and, based on our understanding, we think it will hold true for 2025 as well.

OLED fans have been waiting for more than 10 years for an improved blue OLED emitter, but they are going to have to wait at least one more year to see products with phosphorescent blue emitters.

An efficient blue OLED emitter would be a tremendous boost to the whole OLED industry and especially to the company that develops it. Universal Display Corporation’s (UDC’s) red and green emitter materials allow excellent color and lifetime with high efficiency because phosphorescence allows 100% internal quantum efficiency, whereas the predecessor technology, fluorescence, only allows 25% internal quantum efficiency. A more efficient blue would bring cost and performance benefits to all of the various product architectures in the OLED space. In mobile RGB OLED, UDC projects that displays with phosphorescent blue emitters will achieve a 24% reduction in power consumption compared to 2023 displays.

UDC has worked for years on developing a phosphorescent blue emitter. In February 2022, the company finally announced that it expected to meet commercial target specs by the end of that year and start selling phosphorescent blue emitter materials in 2024. Through mid-2024, UDC held to that timetable but then stated that commercialization had been delayed by “a few months”.

Our sources suggest that phosphorescent blue continues to fail life test requirements for commercial products. According to the latest information, phosphorescent blue emitters have only a 40%-50% lifespan compared to mass-production materials. It is possible that the first introduction of phosphorescent blue will be in a tandem structure, paired with fluorescent emitter materials.

Whenever it comes, the introduction of phosphorescent blue will give OLED technology a boost in its battle with LCD. We believe that displays with these phosphorescent blue emitters will eventually hit the market, just not in 2025.

#3: We Will See More FPD Capacity Expansion in India

We were wrong with this prediction in 2024, but the logic of FPD production in India is stronger than ever, so we repeat the prediction in 2025. The result may not be known with certainty by the end of 2025, so effectively this is a prediction about a prediction (or about a forecast if you prefer).

At several points during the first two decades of the 21st century, there were discussions about building flat panel display fabs in India. Most recently, Vedanta has emerged as the champion of FPD in India. Vedanta already participates in the FPD industry with its ownership of glassmaker Avanstrate which it bought in 2017. The Indian conglomerate also signed a technology licensing agreement with Innolux in early 2023. A year ago, we expected that Vedanta would start mass production of a Gen 8.5 a-Si LCD fab in 2026, but in our current outlook that has been pushed back to the fourth quarter of 2027.

In our latest outlook on FPD capacity, we expect Vedanta’s capacity in 2028 will be 4.2 million square meters, just a bit less than 1% of total industry capacity. We predict that more expansions will be announced and planned in 2025 so that by the end of 2025 our capacity model will show more than 4.2 million square meters of capacity by 2029.

The list of reasons that flat panel display production in India makes sense is even more compelling today than it was a year ago:

- The Indian government has announced a major subsidy program for semiconductors and flat panel displays. The central government will subsidize 50% of the investment in approved FPD capacity, and as much as 20% subsidy may be available from state and local governments.

- Geopolitical relations between the US and China have deteriorated substantially. Although the Biden administration was hardly friendly to China, the incoming Trump administration is likely to be even more antagonistic.

- China dominates the FPD industry, especially in LCD. In 2016, China represented only 30% of worldwide LCD capacity, but by 2025 the country will have 73% of worldwide FPD capacity and 76% of worldwide LCD capacity.

- While economic growth in China has slowed, India has the fastest-growing economy in the 2020s.

- While the population of China has peaked and is falling, India’s young population continues to grow, and it is now the world’s most populous country.

- The domestic TV market in India is the third largest country market in the world after China and the US, but unlike China and the US, the Indian market is continuing to grow. We estimate India’s TV market will grow to 30 million units in 2030 with additional growth thereafter. China’s TV market peaked in 2018 at 59 million units.

Unlike most countries, India has an economy and a market large enough to support a substantial display industry. We estimate the end-market demand for display products across all applications in India to be 16 million square meters in 2024, able to fill almost four fabs the size of Vedanta’s plans. Furthermore, while we expect worldwide FPD demand to grow slowly, we expect FPD demand in India to grow at a double-digit % throughout our forecast horizon.

#4: MiniLED Shipments Will Increase by a Double-digit % in TVs and Monitors and by a Triple-digit % in Autos

In the technology battle between MiniLED and OLED at the top end of large-screen display applications, MiniLED came out favorably in 2024 and we expect that momentum to continue in 2025. In the TV market, according to Counterpoint Research’s Quarterly Advanced TV Shipment and Forecast Report, MiniLED shipments increased by 74% YoY in the first three quarters of 2024 even though Samsung MiniLED TV shipments decreased by 19% YoY. The gap was filled by Chinese brands TCL, Hisense and Xiaomi, which aggressively promoted MiniLED in both their home market and for exports.

TCL was the pioneer of MiniLED technology, launching its first TV product in 2019. However, when Samsung launched MiniLED TVs in 2021, the brand quickly surged to take the #1 spot. In 2024, as Samsung shipments slumped, it fell to the #3 spot behind TCL and Hisense, with the latter brand claiming the #1 spot in Q3 2024. The MiniLED LCD TV landscape has become more varied, with 13 brands represented and 5 brands shipping more than 100,000 units in the latest quarter. For 2025, we expect MiniLED TV shipments to increase by 17% to 7.5 million units.

MiniLEDs in monitors are an even more competitive market, with at least 21 brands with products on the market and the top brand, AOC, capturing only 16% share. We expect that to continue because barriers to entry to the MiniLED monitor market are low to non-existent. We expect MiniLED monitor shipments to increase by 40% YoY in 2025 to 5.2 million units.

Many automakers have favored MiniLED over OLED because they have concerns about the latter technology’s lifetime performance. We have seen a number of autos with large MiniLED displays released in 2024, including the Cadillac XT4 and CELECTIQ and the Krypton ZEEKR 009 Glow. Many panel makers are competing for this business, and shipments for auto displays are expected to increase from 4.5 million in 2024 to more than 10 million in 2025.

#5 Trump Tariffs will Dent Demand and Scramble Display Supply Chain

One of the biggest uncertainties for the display industry, and for many other industries, in 2025 involves whether and how soon-to-be President Trump will follow up on campaign promises to implement tariffs on US trading partners. During the 2024 election campaign, Trump promised to put a 60% tariff on imports from China, and after the election, Trump posted on his Truth Social account that on his first day in office, he would slap a 25% tariff on imports from Mexico and Canada, and a 10% tariff on imports from China, citing immigration and fentanyl trafficking as national security concerns.

Many analysts believe that Trump’s statements are merely opening lines toward a negotiation of more favorable trade terms. The USMCA free trade agreement which was signed by Trump in 2018 comes up for review in 2026, and he is expected to demand changes. Analysts note that Trump also made bold claims about tariffs in his 2016 election campaign, most of which did not materialize.

One area where the tariffs did materialize was against China. In his first term, Trump implemented tariffs on $150 billion of imports from China, which included TVs but not monitors, laptop PCs or smartphones. The tariffs were implemented under a “Section 301” trade clause after an investigation concluded that China was guilty of discriminatory trade practices.

The initial tariff of 15% on TVs was cut in half after Trump announced a “historic” trade deal with Chinese President Xi in January 2020, just as the COVID-19 pandemic was starting. Under that deal, China should have purchased an additional $200 billion in US exports by the end of 2021. Although the disruption of the pandemic was certainly a factor, in the end, those increased exports never materialized. The US trade deficit with China, the number most important to Trump, has declined from an all-time high of $418 billion in 2018 to $279 billion in 2023, but mostly because of reduced imports.

If Trump does follow through in 2025 in implementing tariffs on imports from China or Mexico, it will certainly affect the display industry. As shown in the table below, those two countries account for 80% of the value of imports of end-market products with displays.

The precise impact of a tariff will depend on how it is implemented and how the affected governments and industry players react. We expect that the impact will involve some combination of factors including:

- Price increases in the US for display end products

- A reduction in US demand due to the price increases

- Reduced profits for device makers and retailers in the US due to squeezed margins and reduced demand

- Lower prices for displays, as manufacturers try to push the tariff penalties to suppliers

- A shift in the assembly of end products to countries not affected (like Vietnam and Malaysia)

The most recent statements by Trump promised that tariffs would be implemented on his first day in office, so we may know which tariffs are coming by the end of this month.

#6 Intellectual Property Lawsuits will Constrain Display Suppliers

On top of the threat of tariffs, another front in the US-China trade war involves lawsuits over intellectual property (IP) rights. Two of these cases may result in substantial barriers for certain suppliers in the display industry.

One of these cases is described in a separate article in this newsletter. US glassmaker Corning has petitioned the US International Trade Commission (ITC) to ban imports of products made with display glass from Irico, a Chinese glassmaker that Corning says has used stolen trade secrets and infringed on multiple Corning patents. The ITC is expected to initiate an investigation of the case in early 2025.

Another case dates back several years and is much further advanced. In November 2024, the US ITC concluded its investigation regarding Samsung’s claim that BOE had infringed on several patents in its OLED displays. The presiding administrative law judge (ALJ) issued an Initial Determination on Violation of Section 337 as part of the investigation. The ALJ also issued a “Recommended Determination” on remedy and bonding should a violation ultimately be found in this investigation. The ALJ also issued a solicitation for submissions on public interest issues raised by the recommended relief should the commission find a violation.

In a related move, the Chairman of the US House of Representatives Select Committee on the Chinese Communist Party, John Moolenaar, wrote to the US ITC, urging it to follow through on a ruling and bar BOE Technology Group from importing products to the US. In September, Moolenaar had asked the Pentagon to list BOE as a Chinese military company.

In a December letter to ITC Chair Rhonda Schmidtlein, Moolenaar wrote, “If the commission declines to ban imports of BOE’s displays — which has been clearly implicated in infringing on US patents — BOE’s IP theft will continue to benefit the PRC’s military-civil fusion strategy, and BOE’s growing dominance in the display industry will leave the US overly reliant on the PRC for an advanced technology critical to military applications. Additionally, the commission will be sending a dangerous message to the PRC that its companies can continue to steal American IP at will.”

A third case was initiated in November 2024 concerning alleged infringement by TCL regarding patents held by Maxell of Kyoto, Japan. The ITC initiated an investigation in the case which involves four patents related to smart TV operation and communication.

Any of these cases could result in import bans on products found to be infringing on patents, and any such import ban would significantly affect both the suppliers and the customers in the display supply chain. Given the political environment in Washington with the incoming Trump administration, we can expect that the Chinese defendants in these three cases will not have a sympathetic reception if they attempt to dispute the allegations.

#7 Samsung will Release Smart AR Glasses but Volumes will be Small

The biggest news in the AR/VR device market in 2024 was Apple’s introduction of its Vision Pro headset. The reception to that device is nicely encapsulated by the title of a Forbes article, “Apple’s Vision Pro Is Amazing But Nobody Wants One”. The device got great reviews but sales were disappointing.

Given that Apple could not rejuvenate the Mixed Reality headset market, all eyes are now on the less cumbersome smart glasses. Although the product does not include a display, perhaps the most successful pair of smart glasses came from Meta’s collaboration with Ray-Ban for the Ray-Ban Meta smart glasses. While the lack of a display limited the functionality of the product, its elegant design made it easier to wear, as Meta’s VP of wearables, quoted in the Wall Street Journal, noted: “There’s an analogy — an escalator doesn’t break. It becomes stairs. When these run out of battery, they’re still a beautiful-looking pair of glasses.”

We expect that Meta will follow by launching AR (i.e. with a display) smart glasses in 2025. They will not be the same as the advanced Orion glasses it demonstrated in September and will probably be based on LCoS.

In 2025, we expect Samsung to jump into the ring with a set of AR glasses. Samsung has already announced a Mixed Reality headset powered by Google's new Android XR operating system. However, this device was designed as a response to the Apple Vision Pro and could quickly meet the same fate. Samsung may focus its efforts on smart glasses that can compete head-to-head with Meta's. They will likely be running Android XR, which will give them access to Google's AI assistant. We think that the volume for Samsung’s smart glasses is unlikely to exceed 200,000 units, but this might be considered a success for a first-generation product.

#8 Foldable Phones will Remain Stuck in a Niche Market with No Growth

The great promise of OLED displays made on plastic substrates has been that they will allow innovations in form factor. The transition from glass substrates to polyimide substrates allows displays to bend into shapes that glass can’t manage, and Samsung has taken the lead in bringing this promise to the smartphone in the form of its foldable phones, the Galaxy Z Fold and Z Flip series.

Samsung has progressed through six generations of foldable phones, and we expect a seventh generation to be launched in 2025. The successive generations have mostly resolved some of the problems with the earliest designs, including more robust hinge designs and removing the “crease” in the fold. Other brands including OPPO, vivo and Xiaomi have introduced foldable phone designs, but the most significant competitor to Samsung in the foldable space is Huawei, whose Mate X6 and Pocket 3 foldables drove Huawei’s share of the foldable segment from 18% in 2023 to 33% in 2024.

From their first introduction in late 2018, foldable smartphones posted strong growth in every year up through 2023, but that growth stalled in 2024 and the outlook for 2025 looks even worse. Counterpoint Research now believes the foldable smartphone display market increased only 5% in 2024 and will fall by 4% in 2025. Demand has stalled at around 22 million panels, which is only about 1.5% of the smartphone market in unit terms.

Samsung is seeing slower-than-expected adoption of its Galaxy Z Flip 6 clamshell smartphone as well as older foldables. Panel shipments for the Z Flip 6 in 2024 are expected to be more than 10% below the Z Flip 5 panel shipments in 2023. Demand remains highly concentrated in South Korea and Europe and this product has struggled to gain adoption in the US and China. Huawei also pulled back on panel procurement in the second half of 2024; the Chinese brand has been hurt by the restrictions on importing the most advanced processors in China, which gives it a disadvantage in the premium smartphone market.

The great hope for the foldable smartphone category lies with Apple, but Apple is not expected to launch a foldable phone until 2026 at the earliest. Meanwhile, we expect Huawei to introduce fewer models in 2025 and expect other brands to pull back on legacy models. We expect to see 32 different models shipping in 2025 vs. 41 in 2024. So while we may see another surge of growth in foldable phones in the latter part of the decade, in 2025 the category will remain a niche inside the larger smartphone market.

#9 New LCD Capacity will be Planned

In both 2023 and 2024, we predicted that LCD capacity would be shut down, and we were right both times. So, it may seem odd that we are predicting some new capacity for 2025, but given the rebalancing of supply and demand for LCD, it makes sense that someone will start to plan capacity expansion this year.

As shown in the chart here, the total industry LCD capacity has gone through two years of decline while demand has increased. The industry oversupply was severe in 2022 with only 76% utilization, but that improved to 79% in 2023 and 81% in 2024. In our outlook, we expect LCD capacity growth of less than 1% in 2025 and demand growth of about 5% driven mostly by increasing screen size for LCD TVs. That will bring full-year utilization up to a relatively healthy 85%.

As we explained in our prediction #1 for this year, we expect LCD TV panel prices to increase, which should improve the profitability of TV panel makers. While we think it is unrealistic to expect bumper profits this year, the pattern of improvement in utilizations will be clear to industry players. There is minimal LCD capacity expansion in the pipeline; we expect capacity growth of less than 1% in 2025, less than 3% in 2026 and only 2% in 2027. As a result, with the current outlook, industry utilization would increase to 88% in 2028, which matches the UT% of 2021, the most profitable year in the history of the industry.

We think one or more LCD players will recognize the trends and get ahead of the curve by planning new expansions. This might come from the Chinese heavyweights BOE and CSOT as the two companies battle for the #1 position in capacity, or it might come from a new entrant in India as described in prediction #5.