Latest Insights on Samsung’s Foldable Smartphone Production and Panel Procurement

Latest Insights on Samsung’s Foldable Smartphone Production and Panel Procurement

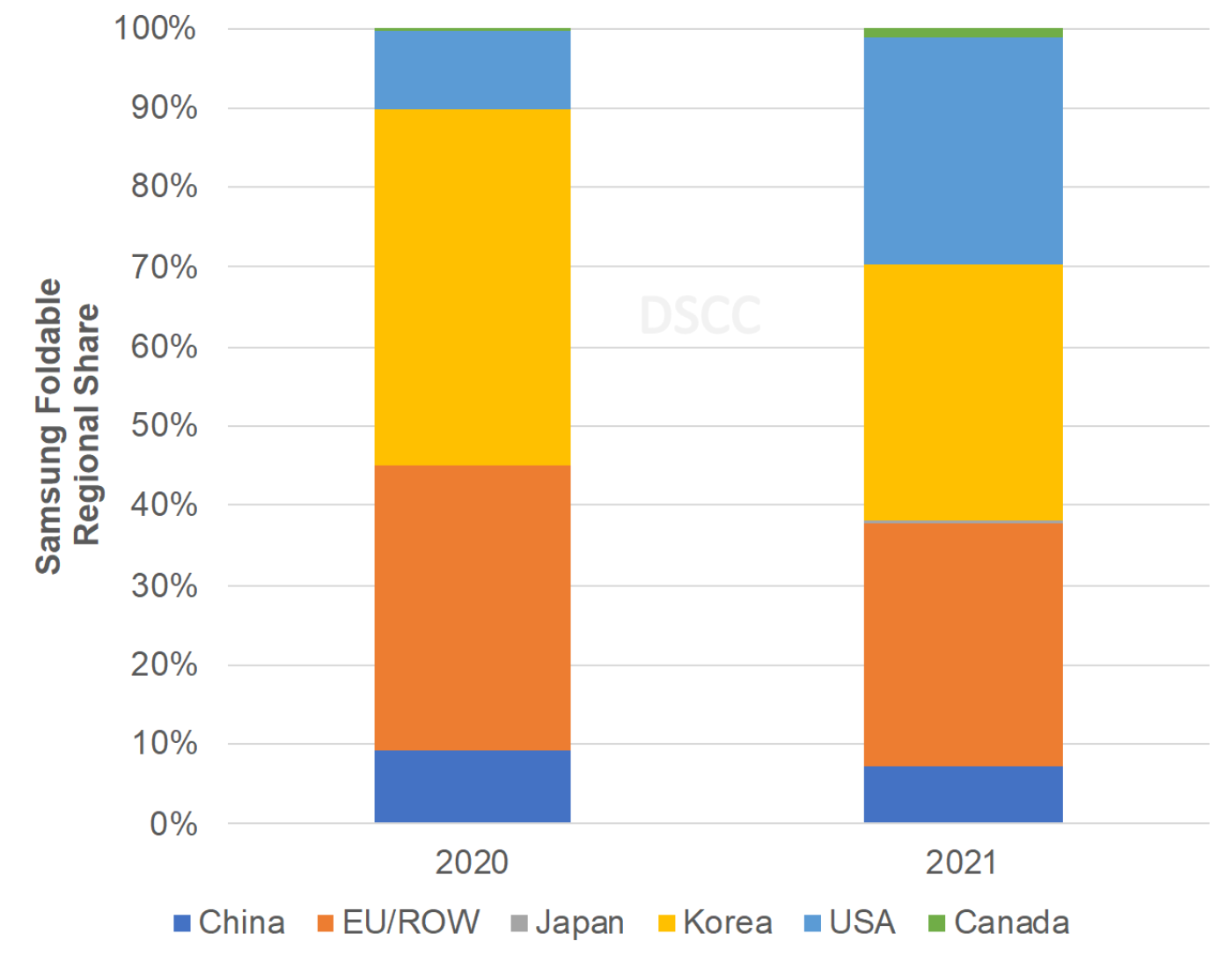

Samsung’s foldable smartphones continue to perform well with December production its second-best month ever at 1.47M, up 3435% Y/Y. The Z Flip 3 accounted for 67% of the total or nearly 1M units. 2021 foldable smartphone production rose nearly 300% to 8.1M units. Korea led Samsung’s demand in 2021 with a 32% share followed by Europe at 31% and the US at 29%. Relative to 2020, the US gained significant share while Europe also remained strong.

Samsung’s Regional Foldable Smartphone Mix

Looking into 2022, we see demand in Europe surging with European/ROW models expected to account for 56% of Samsung’s foldable smartphone production, its first quarter over 50%. Samsung’s Q1’22 output is expected to rise 568% Y/Y to over 1.5M units as the Z Flip 3 in particular remains hot accounting for 70% of output. Sequentially, demand is expected to fall nearly 60% on a seasonal slowdown.

For 2022, Samsung remains encouraged regarding its foldable smartphone prospects. Our supply chain sources indicate it is raising its foldable panel procurement forecast by over 15% relative to its previous target of over 15M panels to over 18M. This should be indicative of even lower device prices for its next product launch in Q3’22.

For DSCC’s latest foldable and rollable device and panel forecasts, please see our Quarterly Foldable/Rollable Display Shipment and Technology Report (一部実データ付きサンプルをお送りします).