FPD製造装置市場規模の最新予測~前回予測との差異分析

冒頭部和訳

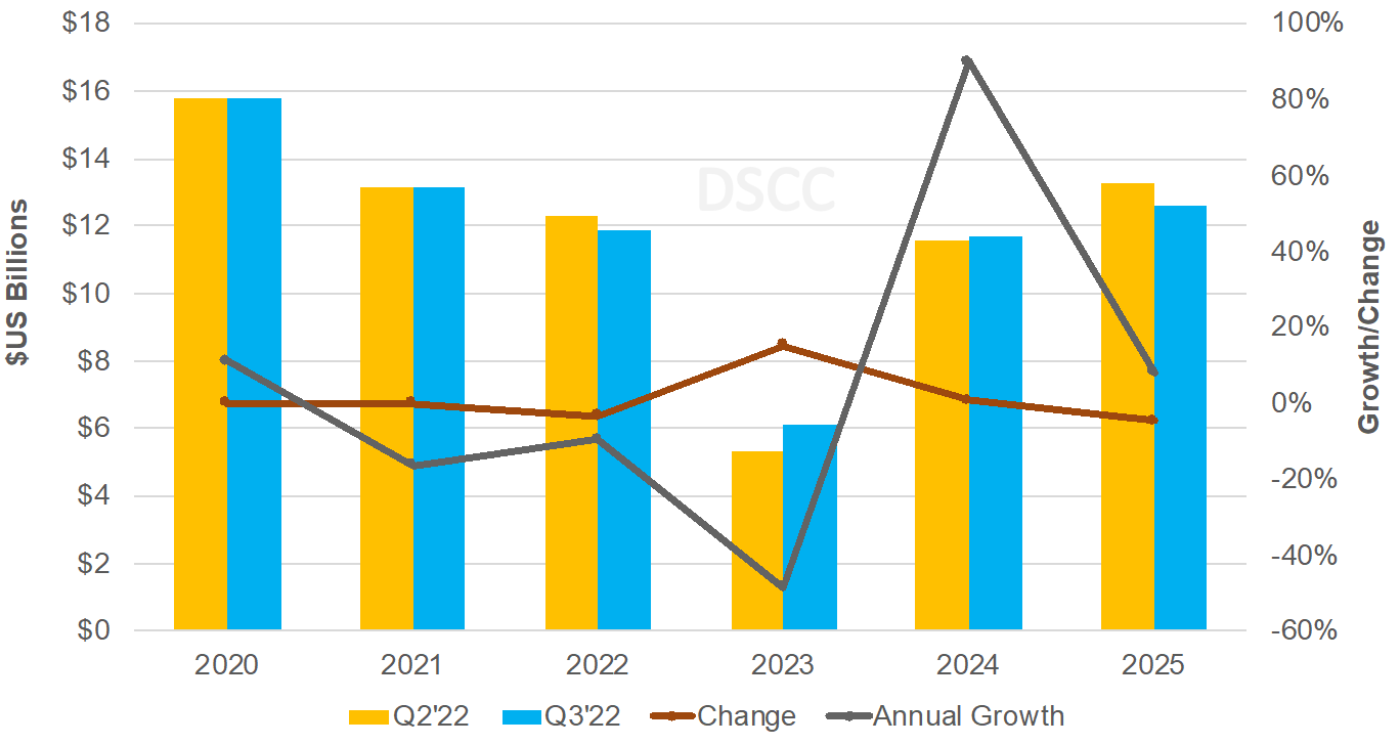

LCD及びOLED製造装置の市場規模 (装置搬入ベース) は、スケジュールの延期や中止が多いわりには比較的変動が少ないことが、DSCCの Quarterly Display Capex and Equipment Market Report (一部実データ付きサンプルをお送りします) 最新版で明らかになった。延期や中止といった生産ラインのスケジュール変更の大部分を、第8.5-8.7世代のFMM VTE (Fine Metal Mask Vacuum Thermal Evaporation: 微細金属マスク加熱真空蒸着) システムの市場規模増加が埋め合わせる形となっている。2020-25年の6年間における総市場規模予測は、レポート前期版の予測から0.2%だけ引き下げの712 億ドルとなったが、FMM VTEの市場規模は前期版予測から18%増となり、2021-25年製造装置の総市場規模に対するシェアが10%から12%に上昇、機器セグメント別では露光装置を上回ってこの期間のトップとなった。

DSCC Updates Display Equipment Spending Forecast – Higher Tandem FMM VTE Prices Help to Minimize Drop

In the latest issue of DSCC’s Quarterly Display Capex and Equipment Market Report (一部実データ付きサンプルをお送りします), total LCD and OLED equipment spending remained relatively flat on a move-in basis despite a number of delays and cancellations. These fab schedule changes were mostly offset by higher spending for G8.5-G8.7 FMM VTE systems. 2020 -2025 spending fell just 0.2% vs. last quarter to $71.2B, while fine metal mask vacuum thermal evaporation (FMM VTE) spending rose from 10% to 12% of 2021-2025 spending, rising 18% from our last issue and overtaking exposure as the leading equipment segment over this period. The higher spend on FMM VTE tools is a result of a shift to larger substrates, full G8.5 and ½ G8.6-G8.7, as well as tandem stack adoption which boosts efficiency, brightness and lifetime and improves the OLED outlook in IT markets. Market leader Canon Tokki is a significant beneficiary of the higher tandem FMM VTE prices. By technology vs. last quarter from 2020-2025, our LCD outlook was reduced by 1% while our OLED outlook was increased by 1%.

By year for LCD and OLED equipment spending:

- 2022 – Reduced by 3% vs. our previous forecast with OLEDs 2% higher and LCDs 8% lower. Fab delays due to weak market conditions affected LCD spending such as at China Star T5. Some additional OLED module tools boosted the OLED outlook. 2022 is now expected to fall 10% to $11.9B, the lowest total since 2015.

- 2023 – Increased by 15% vs. last quarter but is still down 48% Y/Y to $6.1B, the lowest total since 2013. The increase vs. last quarter is a result of a pull-in from 2024 at SDC’s A4/L7-2-2, which is targeting IT OLED panels for Apple and others. OLED spending was upgraded by 25% vs. last quarter as a result of this change but is still expected to fall 29% Y/Y. LCD spending was reduced by 2% from last quarter and is expected to fall 68% Y/Y on the oversupply affecting the LCD market. The latest change in LCD spending was the result of a delay in oxide spending at China Star’s T9 into 2024, which more than offset new oxide conversions at two other lines targeting the IT market.

- 2024 – Display equipment spending is expected to rise 90% vs. 2023 and is up 1% from last quarter to $11.7B. OLED spending is expected to be flat vs. last quarter with the pull-in at SDC’s T8 IT Phase 2 from 2025 to 2024 and higher tandem FMM VTE prices offsetting the L7-2-2 pull-in to 2023 and the removal of EDO’s Fab 3 from our forecast. LCD spending was upgraded by 3% vs. last quarter on the China Star T9 oxide spending and is expected to rise 132% Y/Y.

- 2025 – Our forecast was reduced by 5% vs. last quarter, but still represents a 9% increase over 2024. OLED spending was downgraded by 6% vs. last quarter due to the pull in of Phase 2 at SDC’s T8 IT OLED fab, but is up 20% Y/Y. LCD spending is flat vs. last quarter and is down 41% Y/Y.

DSCC’s Latest LCD and OLED Equipment Spending Forecast and Change vs. Last Quarter

Equipment revenues and market share for all display equipment suppliers across 70 segments are also provided. Canon is expected to lead in 2022 followed by Applied Materials, Nikon, ULVAC and Tokyo Electron. For more information on this report, please contact info@displaysupplychain.co.jp or visit Quarterly Display Capex and Equipment Market Report (一部実データ付きサンプルをお送りします).

本記事の出典調査レポート

Quarterly Display Capex and Equipment Market Report

一部実データ付きサンプルをご返送

ご案内手順

1) まずは「お問い合わせフォーム」経由のご連絡にて、ご紹介資料、国内販売価格、一部実データ付きサンプルをご返信します。2) その後、DSCCアジア代表・田村喜男アナリストによる「本レポートの強み~DSCC独自の分析手法とは」のご説明 (お電話またはWEB面談) の上、お客様のミッションやお悩みをお聞かせください。本レポートを主候補に、課題解決に向けた最適サービスをご提案させていただきます。 3) ご購入後も、掲載内容に関するご質問を国内お客様サポート窓口が承り、質疑応答ミーティングを通じた国内外アナリスト/コンサルタントとの積極的な交流をお手伝いします。