Advanced (先端技術FPD搭載) TV市場~Q2’23は中国ブランド主導で回復

出典調査レポート Quarterly Advanced TV Shipment and Forecast Report の詳細仕様・販売価格・一部実データ付き商品サンプル・WEB無料ご試読は こちらから お問い合わせください。

これらDSCC Japan発の分析記事をいち早く無料配信するメールマガジンにぜひご登録ください。ご登録者様ならではの優先特典もご用意しています。【簡単ご登録は こちらから 】

冒頭部和訳

DSCCの Quarterly Advanced TV Shipment and Forecast Report 最新版 (実績編) によると、Advanced (先端技術FPD搭載) TV市場はQ1’23の低迷後Q2’23に入って出荷数が前年比で増加、中国ブランドの躍進によって回復の兆しが見えている。中国以外の上位3ブランドであるSamsung、LG、Sonyがいずれも低迷した一方、TCLとHisenseがプレミアムセグメントでシェアを伸ばした。

このレポートでは最先端のTV技術 (WOLED、QD-OLED、QDEF (SamsungとTCLはQLEDと呼称) 、MicroLED、4Kおよび8K解像度のMiniLED) を含む、世界のプレミアムTV市場を対象としている。技術、地域、ブランド、解像度、サイズなどの項目ごとに現在と将来のTV出荷数と出荷額を調査、これらすべての技術の成長を予測している。Q3’23版レポートにはQ2’23の出荷実績と2027年までの最新予測を収録している。本稿ではQ2’23出荷実績の概要を紹介し、最新予測については数週間後の記事で取り上げる予定である。

DSCCでは「Advanced TV」を、すべてのOLED TV、8K LCD TV、および量子ドット技術搭載のすべてのLCD TVを含む、先端ディスプレイ技術機能を備えたTVと定義している。このレポートの実績データにより、先端技術LCD TVの機能別分析が可能になっている。2021年までのOLED TVの実績データに含まれるのはLGDのWhite-OLED (WOLED) テクノロジーという1つの製品構成のみだが、Q1’22にはSamsungとSonyから初めてQD-OLED TV出荷が確認され、MicroLED TVも初めて販売が確認されたが、その台数は非常に少ないものだった。

Advanced TV出荷数はQ1’23に前年比で減少したが、Q2’23には前年比4%増の470万台となった。OLED TV出荷数は前年比6%減の125万台だったが、Advanecd LCD TV出荷数は前年比8%増の344万台となった。Advanced TV出荷額は前年比4%減の55億ドルだった。OLED TV出荷額は前年比6%減の20億ドルとなり、Advanced LCD TVについては、出荷数の増加と豊富な製品構成が大幅な価格下落によって相殺され、出荷額が前年比3%減の35億ドルとなった。

地域別に出荷実績を見ると、先進地域が引き続き低迷している。西欧向け出荷数は前年比3%減、出荷額は前年比15%減となった。北米向け出荷数は前年比5%減、出荷額は前年比8%減だった。中国向け出荷数は前年比18%増、出荷額は前年比19%増となっている。アジア太平洋地域向け出荷数は前年比5%増、出荷額は前年比1%減だった。

Advanced TV Market Recovered in Q2’23 Led by Chinese Brands

※ご参考※ 無料翻訳ツール (DeepL)

After a weak Q1’23, the Advanced TV market is showing some signs of recovery led by gains from Chinese brands as shipments increased Y/Y in Q2’23, according to the latest update of DSCC’s Quarterly Advanced TV Shipment and Forecast Report-History, now available to subscribers. The top three brands outside of China – Samsung, LG and Sony – all fared poorly while TCL and Hisense gained share in the premium segment.

This report covers the worldwide premium TV market, including the most advanced TV technologies: WOLED, QD-OLED, QDEF (which Samsung and TCL call QLED) and MiniLED with 4K and 8K resolution. The report looks at current and future TV shipments and revenues by technology, region, brand, resolution and size, and forecasts the growth of all these technologies. The Q3’23 update includes the shipment results for Q2’23 and an updated forecast out to 2027. In this article, we will review the historical results of Q2’23; in another article in a few weeks, we will review the updated forecast.

We define an “Advanced TV” (capitalized) as any TV with an advanced display technology feature, including all OLED TVs, 8K LCD TVs and all LCD TVs with quantum dot technology. The historical data in the report allows analysis by feature for Advanced LCD TVs. The historical data through 2021 for OLED TV includes only one product configuration, LGD’s White-OLED (WOLED) technology, but in Q1 2022 we saw the first volumes for QD-OLED TVs sold by Samsung and Sony and the first sales of MicroLED TVs in very small volumes.

After a Y/Y decline in Q1’23, Advanced TV shipments grew 4% Y/Y in Q2’23 to 4.7M units. OLED TV shipments declined 6% Y/Y to 1.25M while Advanced LCD TV shipments increased 8% Y/Y to 3.44M. Advanced TV revenues decreased by 4% Y/Y to $5.5B. OLED TV revenues decreased by 6% Y/Y to $2.0B while Advanced LCD TV revenues decreased by 3% Y/Y to $3.5B as the increase in units and a richer mix was offset by large price declines.

In shipments by region, developed regions continued to be weak. Shipments to Western Europe declined 3% Y/Y and revenues decreased 15% Y/Y. Shipments to North America declined by 5% and revenues declined by 8% Y/Y. Shipments to China increased by 18% Y/Y and revenues increased 19%. Shipments to Asia Pacific increased 5% Y/Y and revenues decreased 1%.

Advanced TV Shipments by Region

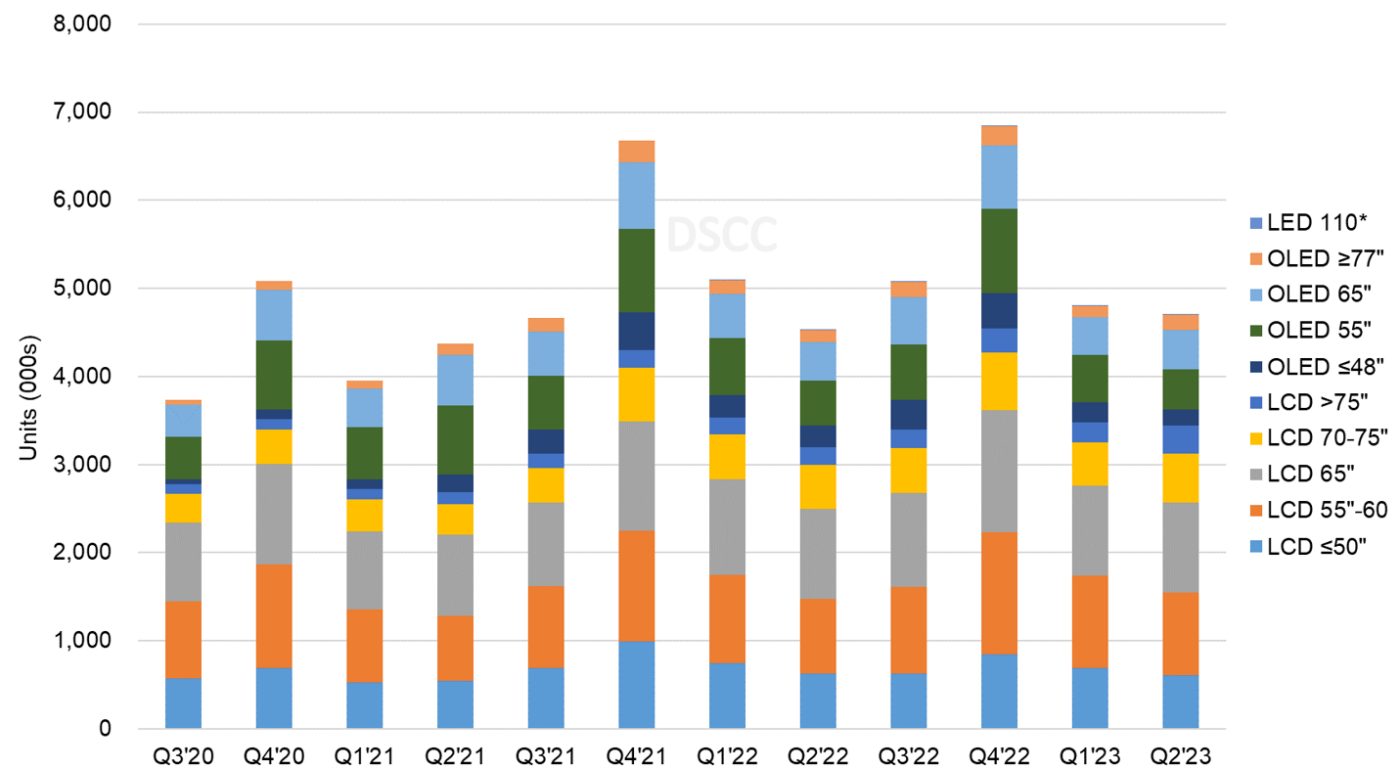

In Q2’23, Advanced TV shipments were up 4% Y/Y. OLED TV share held steady Q/Q but declined 2% Y/Y to 27%. Smaller sizes of OLED TVs decreased Y/Y but 65” and larger sizes increased Y/Y. 48” decreased by 23% Y/Y and 55” OLED decreased 12% Y/Y, while 65” OLED increased by 2% and 77”+ increased by 26% Y/Y.

Advanced LCD TV shipments were up 8% Y/Y, with the largest sizes showing big gains. Advanced LCD TVs ≤50” declined 3% Y/Y and 65” was flat Y/Y, while 55” Advanced LCD TV shipments increased 11% Y/Y, 75” increased 14% Y/Y and >75” shipments increased 54% Y/Y.

Advanced TV Shipments by Size and Display Technology

The report’s pivot tables allow an analysis of brand share by screen size, region, technology, resolution and other variables. In the brand battle, while Samsung maintained the top spot in both units and revenue, it lost ground while its rivals in China gained. In Q2’23, among all Advanced TV products:

- Samsung shipments declined 6% Y/Y and Samsung unit share decreased by 5% Y/Y. Samsung revenues decreased 8% Y/Y and revenue share declined 2% to 44%. Samsung continues to dominate MiniLED TV but share in that segment decreased to 49% as other brands expanded their offerings. Samsung units/revenue share of OLED TV increased to 17%/24%.

- LG shipments decreased by 3% Y/Y and unit share decreased 1% Y/Y to 18% in Q2’23. LG revenues decreased 16% Y/Y and LG lost 3% share to 21%. LG continues to dominate OLED TV with 54%/50% unit/revenue share, but LG has faltered in MiniLED with only 1% share.

- TCL shipments increased 58% Y/Y and TCL gained share Y/Y from 8% to 12%. TCL revenues increased 53% Y/Y and TCL passed Sony for #3 in revenue share.

- Hisense also passed Sony to take #4 in both shipments and revenue as shipments increased 125% Y/Y and revenues increased 118% Y/Y.

- Sony shipments declined 6% Y/Y and Sony dropped from #3 to #5 in both unit and revenue share. Sony revenues declined 15% Y/Y.

Advanced TV Shipments by Brand

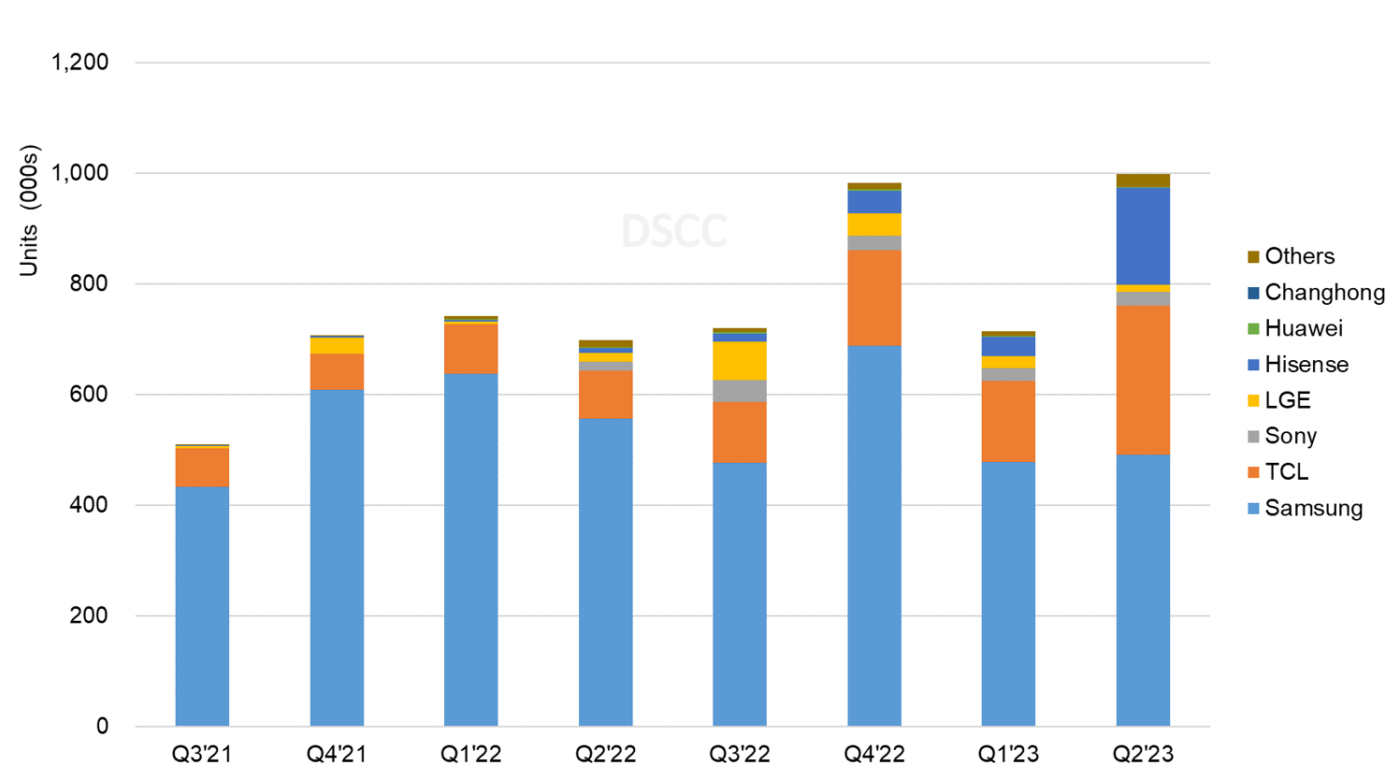

The report tracks the emergence of MiniLED as a competitor to OLED TV in the premium space. The next chart here shows MiniLED TV shipments by brand. While TCL introduced MiniLED in late 2019 and recorded some sales in 2020, the category remained tiny until Samsung and other brands introduced products with MiniLED technology in Q1’21.

MiniLED TV shipments had a great Q2 led by big increases from TCL and Hisense. MiniLED TV shipments increased 43% Y/Y and revenues increased 16% Y/Y. Samsung continues to dominate this category, but its share is declining as others enter. Samsung shipments decreased 12% Y/Y and Samsung unit share declined to 49%. TCL continues to gain share in the #2 position and shipments increased 212% Y/Y and MiniLED share increased to 27%. LG shipments decreased by 20% Y/Y in Q2’23 and LG fell to the #4 brand with only 1% share. Hisense shipments increased by 20x and Hisense captured 17% of MiniLED share. Sony emerged with MiniLED models in 2022 and gained a 3% revenue share in Q2’23.

MiniLED TV shipments have grown Y/Y in 2023 while OLED shipments declined. Total MiniLED TV shipments in Q2’23 were 999K compared to 1.25M OLED TV shipments. Total MiniLED TV revenues in Q2’23 were $1.38B compared to $2.02B for OLED TV. If seen as a single “top of class” category of MiniLED + OLED, OLED has 56% unit share and 59% revenue share.

MiniLED TV Shipments by Brand

In North America, Samsung enjoys a dominant position on the strength of its large-screen product portfolio but has seen its share erode as competitors in both Advanced LCD and OLED TV grow share. Samsung maintained the #1 position, but its unit/revenue share fell by seven/four points Y/Y. LG lost two points of share in units and four points in revenue.

Vizio fell out of the top five brands, replaced by Hisense. TCL increased its share Y/Y by six points in units and by three points in revenue. Sony share declined one point Y/Y in both units and revenue.

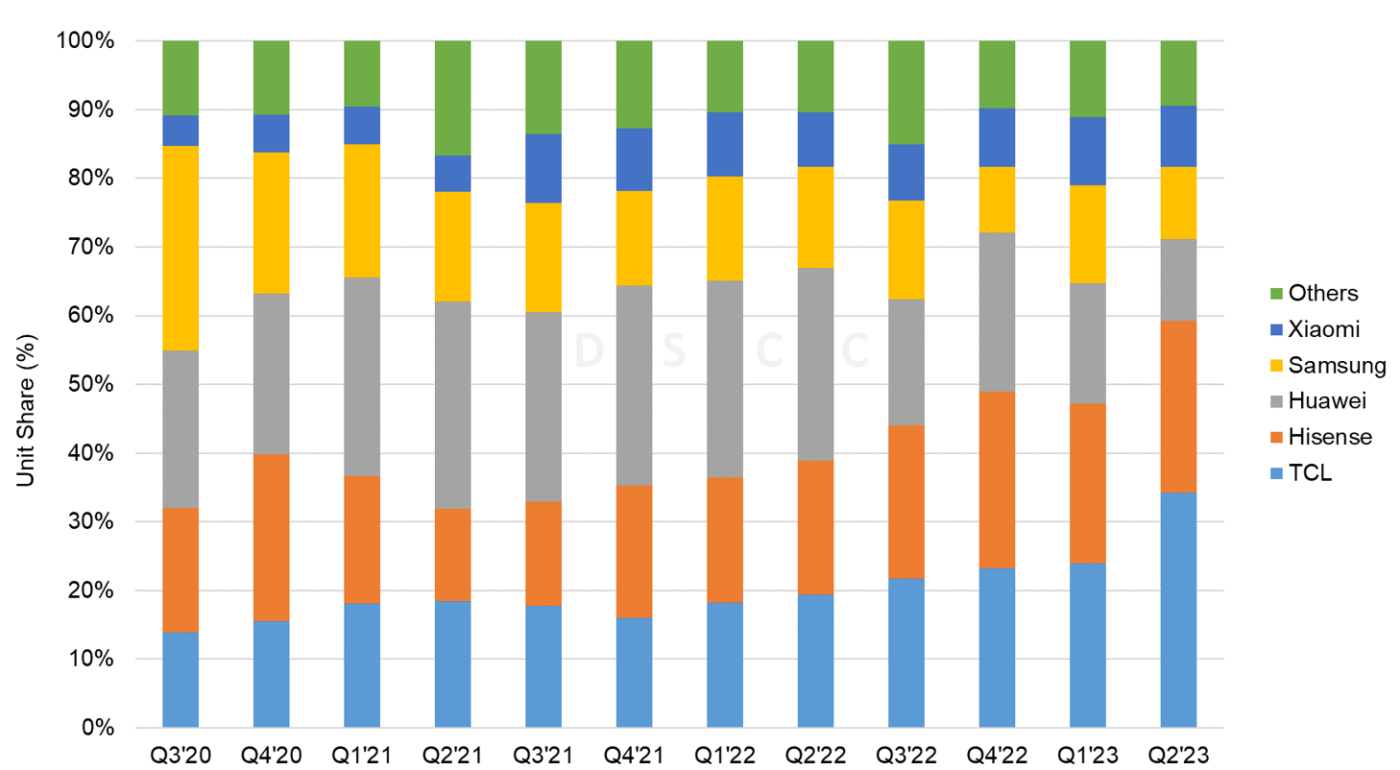

The brand battle continues to be heated in China with four brands with double-digit % share and no clear consistent winner. TCL retained the #1 spot in units and revenue as unit shipments increased 109% Y/Y and revenues increased 101% Y/Y. Hisense shipments increased 52% Y/Y and revenues increased 70% Y/Y and share increased in both units and revenue. Huawei share fell as its shipments decreased 50% Y/Y and revenues decreased 56% Y/Y. Samsung share fell Y/Y as shipments decreased by 14% and revenues decreased by 15%.

Advanced TV Share – China

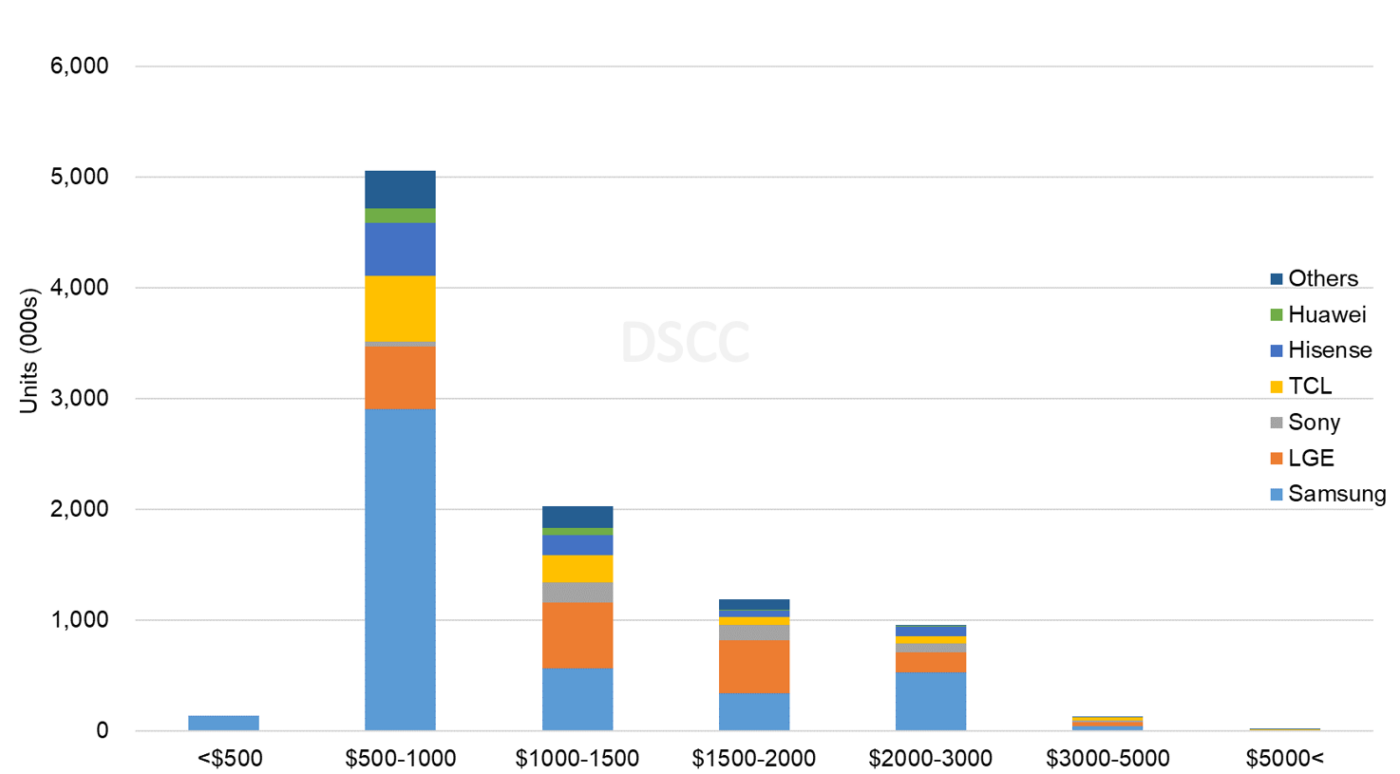

The last chart here shows one last valuable cut of the data, units by brand, by price band. The pivot tables allow for this analysis by any time period, and the chart here shows the market by price band for the first half of 2023. The chart shows that Samsung’s leading position in Advanced TV is mostly a function of its dominance in Advanced TVs under $1000. Samsung’s strategy of pushing its QLED product line toward mainstream price points has allowed it to lead, but other brands, especially TCL and Hisense, are increasing their Advanced TV offerings at these lower prices. LG’s OLED TVs give it the leading position in the range of $1000-$2000, and Sony battles with Hisense and TCL for the #3 position in price points above $1000. Sales volumes at price points over $5000 form only a tiny slice of the market.

Worldwide Advanced TV Units by Price Band for Q1’23-Q2’23

DSCC’s Quarterly Advanced TV Shipment and Forecast Report includes technical descriptions of all major advanced TV display technologies, plus quarterly shipment results from Q1’18 through Q2’23, sortable by technology, region, brand, resolution and size, and includes pivot tables for analysis of units, revenues, ASPs and other metrics. The report includes DSCC’s quarterly forecast for five years across technology, region, resolution and size.

出典調査レポート Quarterly Advanced TV Shipment and Forecast Report の詳細仕様・販売価格・一部実データ付き商品サンプル・WEB無料ご試読は こちらから お問い合わせください。