2024年のFPD設備投資、業界回復で47%増の見込み

これらDSCC Japan発の分析記事をいち早く無料配信するメールマガジンにぜひご登録ください。ご登録者様ならではの優先特典もご用意しています。【簡単ご登録は こちらから 】

冒頭部和訳

- FPD業界の市況改善で2024年FPD設備投資は47%増の73億ドルが見込まれている。

- 2025-2027年はIT市場向け次世代OLED生産ライン投資が大きな起爆剤となり、70億-80億ドル前後で推移すると予想される。これらの新たな生産ラインによって大型OLED (10-20インチ) のコストは低下するはずだ。

- OLED IT需要は2023年から2028年にかけて年平均成長率46%で増加し、6000万パネルを超えると予測される。

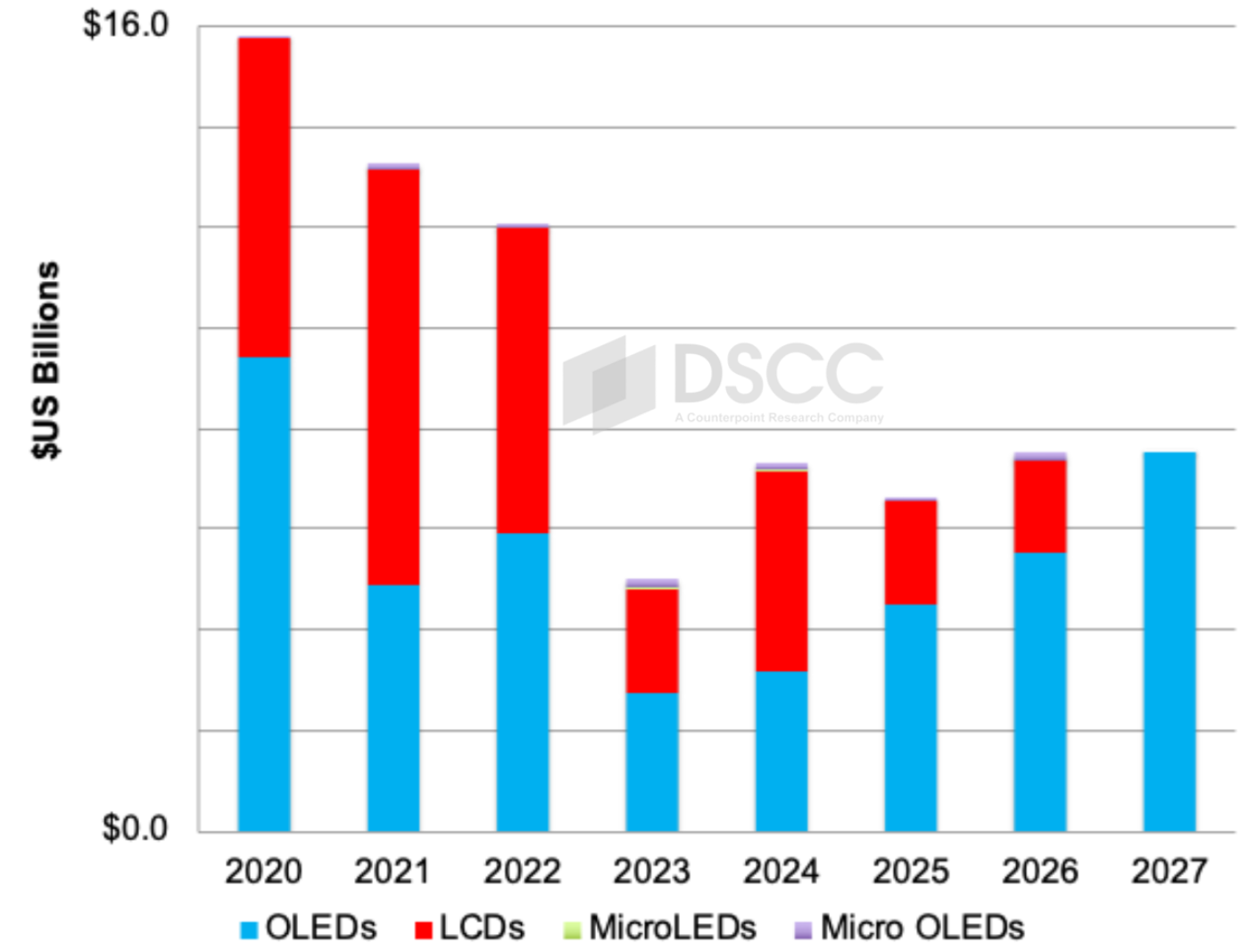

DSCCが Quarterly Display Capex and Equipment Market Share Report 最新版で、FPD設備投資は2023年の低迷から回復し2024年には47%増の73億ドルに達すると予測している。LCD設備投資は2023年に、コロナ禍後のLCD市場の低迷、LCDの大幅な供給過剰、LCDメーカーの純損失などの要因で67%もの大幅削減となったが、その後の2024年は成長率95%でシェア54%となり、主導的役割を果たすと見られる。市況が改善し需要が回復したため、LCD製造装置投資は増加している。OLED製造装置投資も2023年に54%減となったが2024年には16%増に回復する見通しで、多くのメーカーがLCDとOLEDの両技術に取り組んでおり、LCD低迷の影響はOLED業界にも及んでいたことがわかる。OLEDは多くのディスプレイ用途でシェアを獲得しているが、OLED TVの需要が低迷しているため、OLED設備投資は抑えられている。

Display Equipment Spending Expected to Rise 47% in 2024 as Industry Rebounds

- Improved display industry market conditions to drive 47% growth in 2024 display equipment spending to $7.3B.

- 2025-2027 expected to hover around $7B-$8B with spending on next generation OLED fabs for IT markets a major catalyst. These new fabs should bring OLED costs down for larger (10”-20”) panels.

- OLED IT demand expected to rise at a 46% CAGR from 2023 to 2028 to over 60M panels.

Display equipment spending is expected to bounce back from a weak 2023 and rise 47% in 2024 to $7.3B according to DSCC’s latest Quarterly Display Capex and Equipment Market Share Report. LCD equipment spending is expected to lead the way with a 54% share on 95% growth after spending was slashed 67% in 2023 due to weak post-COVID LCD market conditions, a significant LCD oversupply and net losses for LCD suppliers. As conditions have improved and demand has rebounded, LCD fab spending has increased. OLED fab equipment spending is also expected to recover in 2024, up 16%, after falling 54% in 2023 with the OLED industry not immune from LCD weakness as many of the manufacturers are the same in both technologies. While OLEDs have been taking share in many display applications, weakness in OLED TV demand has kept a lid on OLED capex.

Looking forward, display equipment spending is not expected to fall back to 2023 levels. Instead, spending is expected to hover around the $7B-$8B figure for the next few years as OLED fab spending grows to meet rising demand for OLEDs in most applications. In particular, the IT market consisting of laptops, tablets and monitors, is expected to surge requiring new capacity optimized for these products. Those markets are expected to rise at a 46% CAGR on a unit basis from 2023 to 2028 to over 60M panels.

Looking at the latest quarter’s new fab projects, there are a number of interesting developments.

- In OLEDs, there are a number of G8.7 IT OLED fabs coming in the forecast period which are expected to account for 52% of all display equipment spending between 2024 and 2027. These fabs are expected to reduce the costs for making 10”-20” panels for the IT markets and help boost OLED penetration in these and other markets. Mobile OLED spending is continuing as well with a couple of new G6 fab lines being added over the forecast as well as more LPTO and CoE conversions which will also help boost spending.

- In LCDs, there are a few LCD fab investments targeting ultra-large TVs 85” and over which require some specialized equipment. There are also some examples of LCD manufacturers looking to boost transparency for AR/VR applications by adopting an LTPO backplane. There is also a large LCD investment from a new player targeting the e-reader market with a new type of LCD-based reflective technology.

DSCC’s Quarterly Display Capex and Equipment Market Share Report tracks all fab projects and equipment spending in the LCD, OLED, Micro OLED and MicroLED markets. In addition, market share is provided for over 70 different equipment segments with revenues show for 175 different equipment suppliers.

出典調査レポート Quarterly Display Capex and Equipment Market Share Report の詳細仕様・販売価格・一部実データ付き商品サンプル・WEB無料ご試読は こちらから お問い合わせください。