FPD装置市場予測を更新~Micro OLED設備投資および生産ラインスケジュールの四半期追跡を開始

出典調査レポート Quarterly Display Capex and Equipment Market Share Report の詳細仕様・販売価格・一部実データ付き商品サンプル・WEB無料ご試読は こちらから お問い合わせください。

これらDSCC Japan発の分析記事をいち早く無料配信するメールマガジンにぜひご登録ください。ご登録者様ならではの優先特典もご用意しています。【簡単ご登録は こちらから 】

冒頭部和訳

人気のヘッドセット、Apple Vision Proに対する関心は高く、採用されているOLEDの価格が高いという噂もあり、このセグメントでは動きが急激に活発化しています。皆様の強い関心に応えるため、DSCCはお客様からご好評をいただいている Quarterly Display Capex and Equipment Market Share Report にMicro OLED生産ラインスケジュールと設備投資の実績と予測を追加しました。同レポートでは、LCD、OLED、MicroLED、そして今回追加のMicro OLEDを含む約80セグメントの製造装置市場シェアを追跡しています。

DSCCのCEOであるRoss Youngは次のように述べています。「レポート最新版では、市場の加速にともなう生産能力増強に対する強い需要を受け、2024年がMicro OLED設備投資の当面のピークになると予測している。DSCCでは、Appleが2024年中盤に中国で2社目のFPDメーカーとデザイン・インを実施し、現在供給を受けているFPDメーカーとの競争を促進することで、パネル価格の低下、将来的な販売価格の低下、生産量の増加を実現していくと予測している。2020年から2026年の期間、Micro OLED設備投資の85%を中国が占めると予想され、他のFPD技術同様、Micro OLEDでも中国が高い市場シェアを確保する。同レポートはMicro OLEDメーカーが購入する製造装置に焦点を当てているが、そこに含まれるのはOLEDフロントプレーン、カラーフィルター、一部のバックプレーン装置などで、大半の企業はファウンドリやパートナーからパターン済みのCMOSウェハを購入している」

DSCC Initiates Quarterly Micro OLED Equipment Spending and Fab Schedule Tracking, Added to Highly Popular Report

Given the popularity of and interest in the Apple Vision Pro headset and the rumored high prices of the Micro OLED panels being used, there has been a surge in activity in this segment. In response to strong interest, DSCC has added quarterly tracking and forecasting of Micro OLED fab schedules and equipment spending to its highly popular Quarterly Display Capex and Equipment Market Share Report. This report now tracks equipment market share in nearly 80 different segments for LCDs, OLEDs, MicroLEDs and now Micro OLEDs as well.

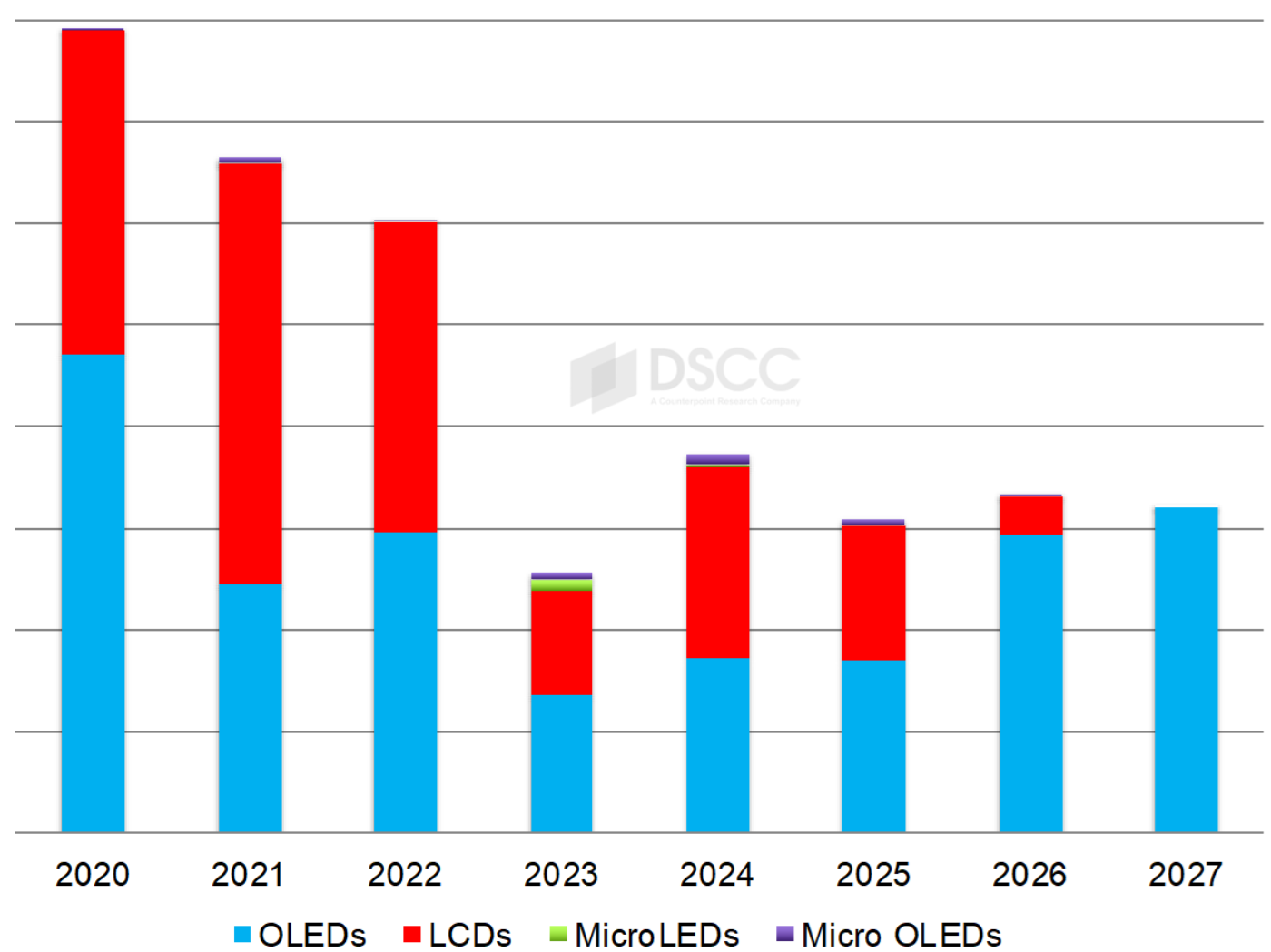

According to DSCC CEO Ross Young, "The latest report shows that 2024 is expected to be the peak year in Micro OLED fab spending in the near term, as shown below, in response to strong demand for more capacity as the market accelerates. In fact, DSCC expects Apple to design in a second panel supplier in 2024 from China around mid-year to boost competition with its current supplier resulting in lower panel prices, lower street prices in the future and higher volumes. China is expected to account for 85% of Micro OLED equipment spending from 2020-2026, ensuring high market share in Micro OLEDs as with other display technologies. The report focuses on equipment purchased by Micro OLED panel suppliers which includes OLED frontplane, color filter and limited backplane equipment with most companies purchasing patterned CMOS wafers from foundries and partners."

Micro OLED Equipment Spending

In terms of total display equipment spending from 2020-2026, DSCC has lowered its outlook by 3.5% to $67B due to one cancellation, JDI’s G6 eLEAP OLED fab, and delays at G8.7 IT OLED fabs from BOE, LGD and Visionox, which more than offset 12 new smaller LCD and OLED investments. In 2024, DSCC expects spending to rise 49% to $7.6B before falling 19% in 2025 to $6.2B. The delays have smoothed out the 2024-2027 spending figures which now range between $6B and $8B per year. While OLEDs led 2023 spending with a 54% share, LCDs are actually expected to lead in 2024 with a 50% share with OLEDs at 46% and Micro OLEDs at 4%. OLEDs should reclaim leadership in 2025 at 55% with LCDs at 43%.

DSCC’s Display Equipment Spending Forecast*

By equipment supplier for all segments, the Canon group, which also includes Tokki and Anelva, led with a 10% share followed by Applied Materials at 8% and Nikon at 4%. Of the top 15 suppliers, there were six from Japan, four from China, three from Korea and two from the US. In 2024, DSCC forecasts Canon’s share will rise to 13% with AMAT’s share rising to 9% and Nikon’s share rising to 7%. Seven of the top 15 companies should see at least 100% Y/Y growth and there are expected to be eight companies from Japan in the top 15 with four from Korea, two from China and one from the US.

By panel supplier from 2020-2027, DSCC shows BOE leading with a 24% share followed by China Star at 18%, Tianma at 11%, HKC at 10%, Visionox at 9%, LGD at 8% and SDC at 7%. China Star led in 2022 and 2023, SDC is expected to lead in 2024 and BOE is expected to lead in 2025.

出典調査レポート Quarterly Display Capex and Equipment Market Share Report の詳細仕様・販売価格・一部実データ付き商品サンプル・WEB無料ご試読は こちらから お問い合わせください。