Q2’24のフォルダブル型スマートフォン用パネル出荷数は過去最高を記録~Samsung製品の発売前倒しが貢献

出典調査レポート Quarterly Foldable/Rollable Display Shipment and Technology Report の詳細仕様・販売価格・一部実データ付き商品サンプル・WEBご試読は こちらから お問い合わせください。

これらDSCC Japan発の分析記事をいち早く無料配信するメールマガジンにぜひご登録ください。ご登録者様ならではの優先特典もご用意しています。【簡単ご登録は こちらから 】

記事のポイント

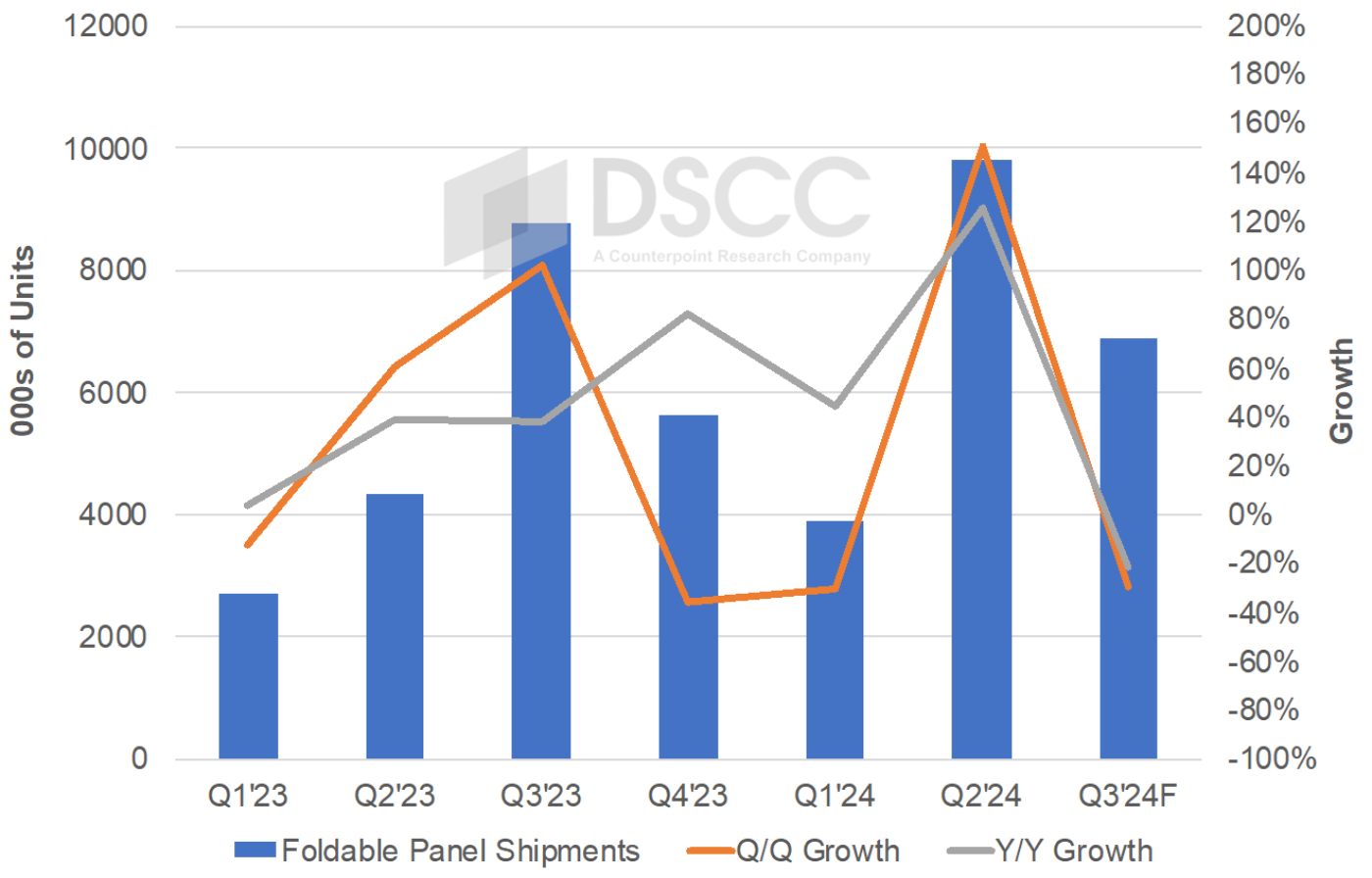

- Q2’24のフォルダブル型パネル出荷数は前期比151%増、前年比126%増の980万枚で過去最高を記録、Samsungのフォルダブル型最新機種、Galaxy Z Flip 6とZ Fold 6の発売が昨年モデルより前倒しとなったことが大きな要因。Q2’24は2024年のフォルダブル型パネル出荷のピーク四半期になると予測される。

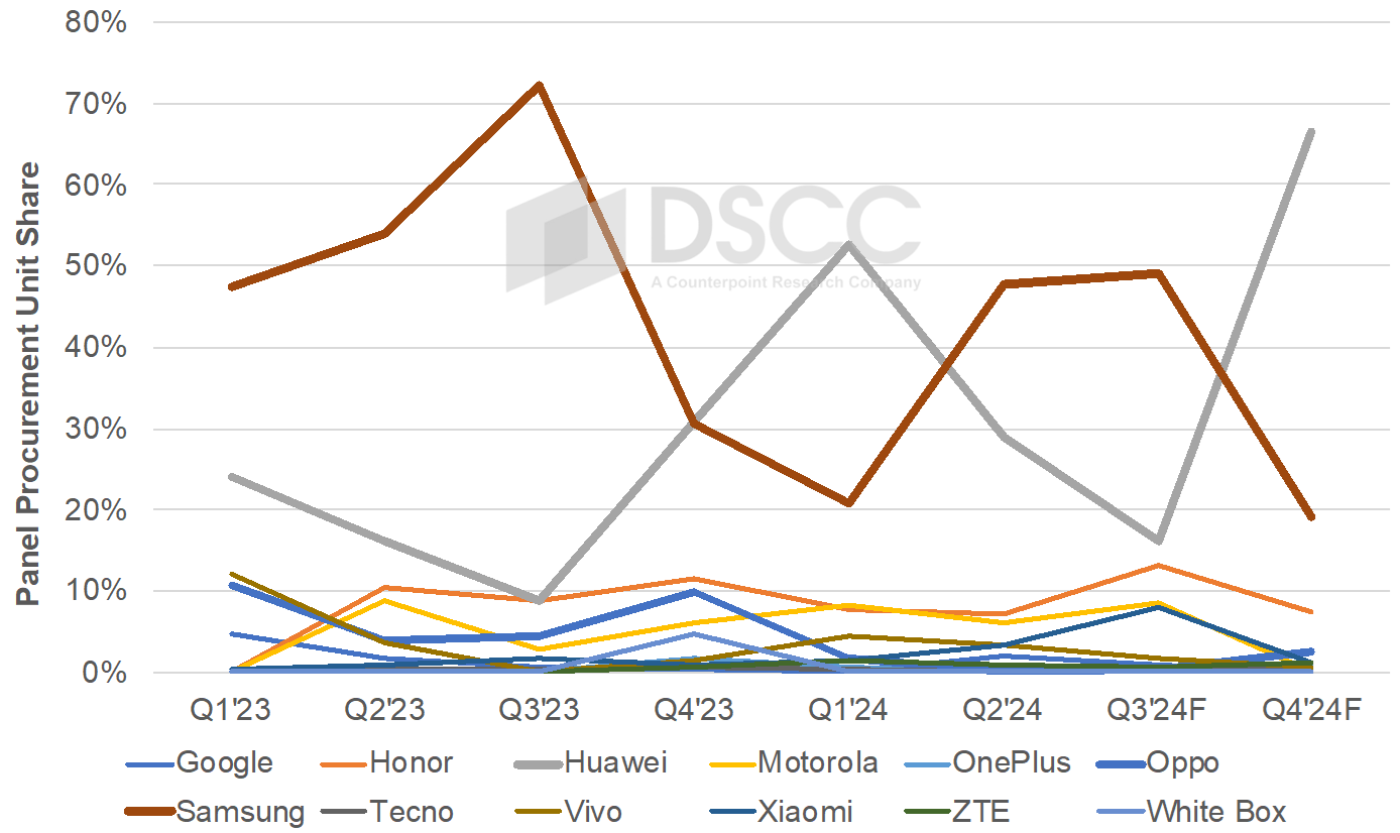

- Q2’24のフォルダブル型パネル調達はSamsungがシェア48%で圧倒、Huaweiが29%で続いており、Huaweiが53% vs. 21%でリードしたQ1'24とは立場が逆転した。パネル調達ベースではSamsungがQ2'24の上位2機種を占め、次いでHuaweiの2機種、Honorの1機種となった。

- Q3’24のフォルダブル型パネル出荷数は前期比30%減、前年比21%減の690万枚となる見通しで、これまでで3番目に多い出荷数だが、Samsungの出荷時期の変更により、第3四半期としては初めて前年比で減少する。Q3'24はSamsungがシェアを49%に拡大、Huaweiのシェアは16%に低下すると予測される。

Q2’24はフォルダブル型スマートフォン用パネル出荷数が過去最高を記録、前期比151%増、前年比126%増の980万枚となった。パネル出荷数はこれまでの最高記録だったQ3'23を12%上回った。出荷数急増のおもな要因は、Samsungのフォルダブル型最新機種Galaxy Z Flip 6とZ Fold 6の発売が昨年モデルより前倒しとなり、パネルの生産と出荷が1ヵ月早く始まったことである。Q2’24のフォルダブル型パネル調達はSamsungがシェア48%でHuaweiのシェア29%を大きく上回った。Q1'24のフォルダブル型パネル調達ではHuaweiがSamsungを53% vs. 21%でリードしたが、Q2'24ではSamsungとHuaweiの立場が逆転した。モデル別では、SamsungのGalaxy Z Flip 6がフォルダブル型パネル調達ベースでシェア32%の首位、Z Fold 6が15%で続いた。次いでHuaweiがPocket 2とMate X5の2モデルでそれぞれ2桁シェアを獲得した。Honor Magic V Flipがシェア4%で第5位となった。クラムシェル型のシェアはQ1'24の53%から上昇し63%となった。Q2'24はSamsung Displayがシェア53% vs. 27%でBOEを引き離してフォルダブル型パネル首位の座を奪還した。Q1'24はBOEが48% vs. 29%でリードしていた。

Q3'24のフォルダブル型スマートフォン用パネル出荷数は前期比30%減、前年比21%減の690万枚になる見通しで、これまでで3番目に良い四半期となるが、Samsungの出荷時期の変更により、第3四半期としては初めて前年比で減少する。Samsungのシェアはやや上昇し49%、Huaweiはまずまずの期待を集めるNova Flipが最近発売されたがパネル調達は激減しており、シェアは16%に低下すると見られる。HonorはMagic V3/Vs3の躍進でHuaweiとの差を縮め、シェアは13%に達すると予測される。モデル別では、Galaxy Z Flip 6がパネル調達ベースでシェア32%として首位を維持、次いでZ Fold 6がシェア13%で第2位、Huawei、HONOR、Xiaomiが第3位、第4位、第5位となる見通しだ。HuaweiがQ2’24に開始したマルチフォールド用パネル調達はQ3’24に数量が急増し、インフォールド型とマルチフォールド型の両方の台頭によってクラムシェル型のシェアは54%への低下が予測される。Q3'24のパネルメーカー別シェアはSamsung Displayが54%へ、BOEが28%へと両社ともやや上昇、China StarがVisionoxを抜いて第3位になる見通しだ。Q4'24にはBOEが顧客の季節動向によってパネルメーカー首位に返り咲き、Huaweiもブランド首位への返り咲きが予測される。2024年通年のパネル調達シェアはSamsungがHuaweiを39% vs. 36%でリード、HONORが9%で第3位になると見られる。

------------------------------------

DSCCの Quarterly Foldable/Rollable Display Shipment and Technology Report では、フォルダブル型スマートフォン、ノートPC、タブレットの各市場に関する詳しい洞察を提供しています。

出典調査レポート Quarterly Foldable/Rollable Display Shipment and Technology Report の詳細仕様・販売価格・一部実データ付き商品サンプル・WEBご試読は こちらから お問い合わせください。

[原文] Foldable Smartphone Panels Set New Record High in Q2’24 Helped by Earlier Launch of Samsung Foldables

- Foldable panel shipments reached a new high in Q2’24 rising 151% Q/Q and 126% Y/Y to 9.8M panels, helped by the earlier launch of the latest Samsung foldables, the Galaxy Z Flip 6 and Z Fold 6. Q2’24 is expected to be the peak quarter for 2024 foldable panel shipments.

- Samsung dominated Q2’24 foldable panel procurement in Q2’24 with a 48% share followed by Huawei at 29%, reversing positions vs. Q1’24 when Huawei held a 53% to 21% advantage. Samsung accounted for the top two models in Q2’24 on panel procurement basis followed by two models from Huawei and one model from Honor.

- Q3’24 foldable smartphone panel shipments are expected to fall 30% Q/Q and 21% Y/Y to 6.9M, the third best quarter to date but the first Q3 to decline Y/Y due to the change in Samsung’s timing. Samsung is expected to gain share in Q3’24 to 49% with Huawei slipping to 16%.

Q2’24 was a record quarter for foldable smartphone panel shipments, rising 151% Q/Q and 126% Y/Y to 9.8M panels. Panel shipments were 12% higher than the previous high recorded in Q3’23. The primary cause of the surge was the earlier launch of the latest Samsung foldables, the Galaxy Z Flip 6 and Z Fold 6, which started panel production and shipments one month earlier than last year. Samsung accounted for 48% of all foldable smartphone panel procurement in Q2’24, well ahead of Huawei’s Q2’24 share of 29%. Samsung and Huawei reversed positions in Q2’24 with Huawei leading Samsung in foldable panel procurement in Q1’24 with a 53% to 21% advantage. By model, the Samsung Galaxy Z Flip 6 led in foldable panel procurement with a 32% share followed by the Z Fold 6 at 15%. Huawei had the next two highest volume models, the Pocket 2 and Mate X5, each with a double digit share. The Honor Magic V Flip was the #5 foldable in Q2’24 on a panel procurement basis with a 4% share. Clamshells accounted for a 63% share, up from 53% in Q1’24. Samsung Display regained the #1 position in foldable panel share with a 53% to 27% advantage over BOE in Q2’24 after trailing BOE in Q1’24 at 29% to 48%.

In Q3’24, the foldable smartphone panel market is expected to fall 30% Q/Q and 21% Y/Y to 6.9M, the third best quarter to date but the first Q3 to decline Y/Y due to the change in Samsung’s timing. Samsung’s share is expected to rise slightly to 49% with Huawei’s share falling to 16% on a sharp decline in procurement despite the recent launch of the Nova Flip, which has modest expectations. Honor is expected to earn a 13% share as it closes the gap with Huawei on gains by the Magic V3/Vs3. The Galaxy Z Flip 6 is expected to remain the #1 model on a panel procurement basis with a 32% share followed by the Z Fold 6 at 13%. Huawei, Honor and Xiaomi are expected to account for the #3, #4 and #5 models. The clamshell share is expected to fall to 54% as both in-folding and multi-folds gain ground with Huawei beginning panel procurement for its upcoming multi-fold in Q2’24 with volumes surging in Q3’24. Samsung Display’s panel share is expected to rise slightly to 54% in Q3’24 with BOE’s share also rising slightly to 28% and China Star overtaking Visionox for #3. In Q4’24, however, BOE is expected to regain the lead as a result of the seasonality of their customers with Huawei also regaining leadership. For all of 2024, however, Samsung is expected to enjoy a 39% to 36% lead over Huawei on a panel procurement basis with Honor #3 at 9%.

For more insight into the foldable smartphone, laptop and tablet markets, please see DSCC’s Quarterly Foldable/Rollable Display Shipment and Technology Report.