Q4’24 先端技術TVの世界出荷数は前年比51%増~Samsungが首位、TCLがLGを抜いて第2位に浮上

出典調査レポート Global TV Shipments Quarterly Tracker の詳細仕様・販売価格・一部実データ付き商品サンプル・WEB無料ご試読は こちらから お問い合わせください。

これらCounterpoint Research FPD部門 (旧DSCC) 発の分析記事をいち早く無料配信するメールマガジンにぜひご登録ください。ご登録者様ならではの優先特典もご用意しています。【簡単ご登録は こちらから 】

記事のポイント

- Q4’24世界TV出荷数は前年比2%増で3四半期連続の前年比増となった

- 先端技術TV出荷数は前年比51%増、QD LCD TVとMiniLED LCD TVが引き続き増加した

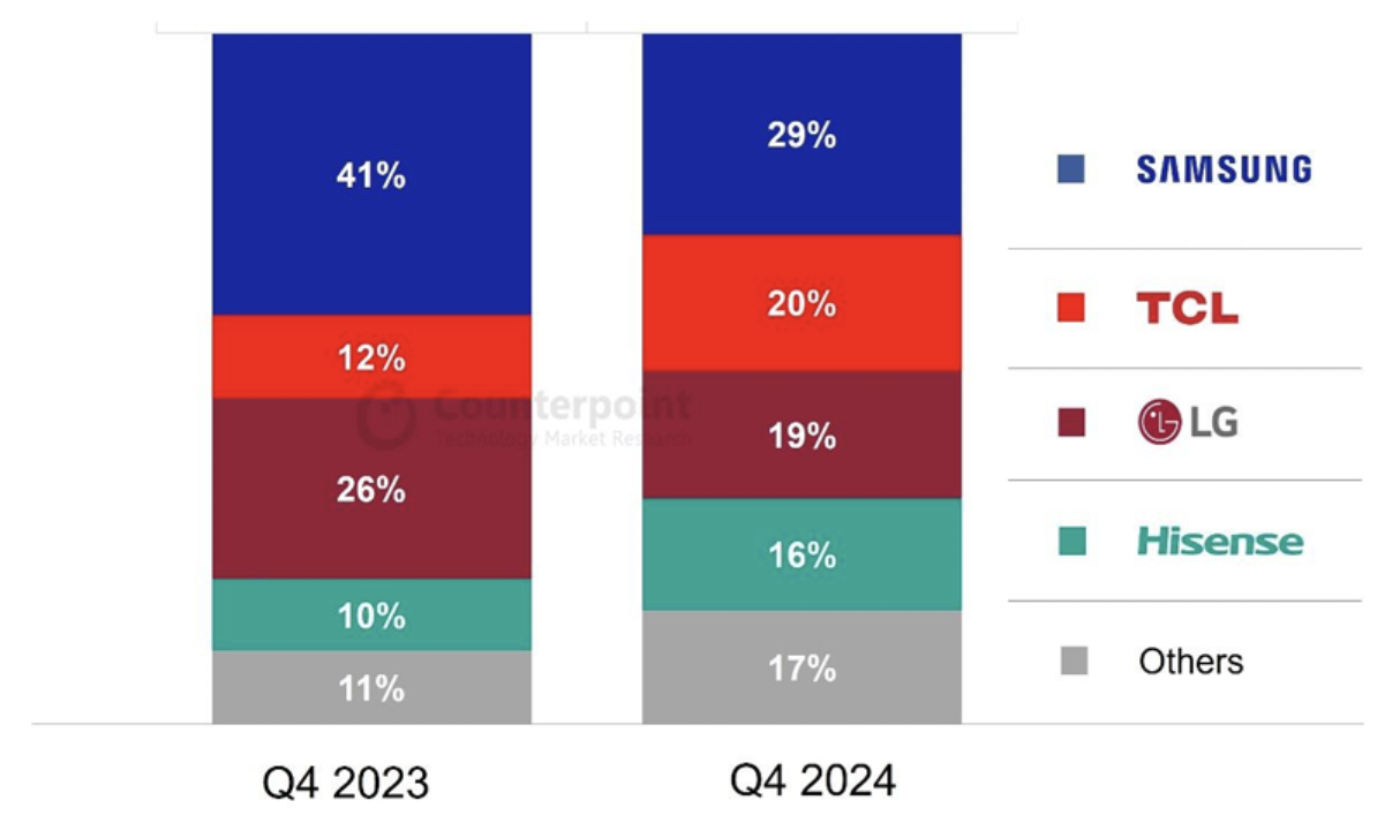

- TCLが先端技術部門で急成長し市場シェア20%を獲得、LGを抜いて第2位に浮上した

- 北米で先端技術TV販売が多いTVメーカーに対するトランプ関税の悪影響が懸念される

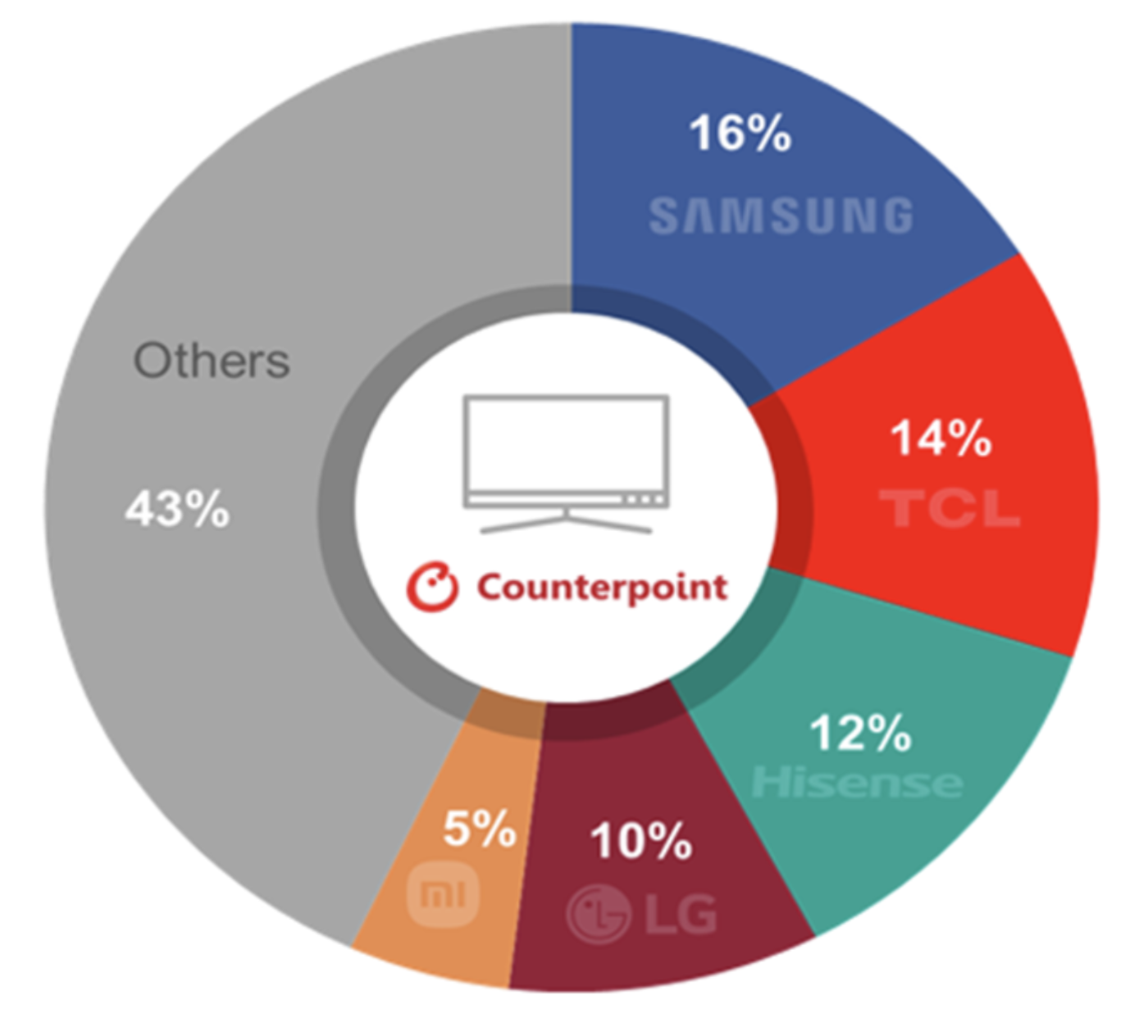

Counterpoint Researchが先日発刊した Global TV Shipments Quarterly Tracker によると、Q4’24の世界TV出荷数は前年比2%増の6100万台に達した。2024年の年間TV出荷数は2億3000万台に到達、こちらも前年比2%増となった。大半の地域が成長を示す一方、日本は前年比15%減、アジアは前年比4%減とTV市場が縮小している。Q4’24はSamsungがシェア16%で首位を維持、第2位のTCLがシェア14%でSamsungを猛追している。Hisenseはシェア12%で第3位、LGはシェア10%で第4位を維持し、前年同期と同様の結果となった。

QD-MiniLED TV、QD-LCD TV、NanoCell TV、LCD 8K TV、QD-OLED TV、WOLED TV、MicroLED TVで構成される先端技術TVモデル出荷数は前年比51%増で過去最高を記録した。2024年通年の出荷数は前年比38%増だった。

高成長が期待される先端技術市場に対し中国ブランドが攻勢を強めるなか、Samsungの市場シェアは前年同期比12パーセントポイント減の29%に低下した。一方、TCLは前年同期の2倍以上の先端技術TVを出荷し、LGを抜いて先端技術TV市場で第2位となった。

先端技術TV市場ではMiniLED LCD TVの出荷数が前年比170%以上増加、第2四半期以来のOLED TVを超える出荷数となった。QD-LCD TVも46%以上の伸びを示し、四半期出荷数で初めて500万台を超えた。Counterpoint ResearchのリサーチャーであるCalvin Leeは、「トランプ政権の『関税爆弾』が実行に移されれば、メキシコ製TVも25%の対メキシコ関税の影響を受ける。特に、北米の先端技術TV市場で大きな部分を占める韓国企業がより大きな影響を受けると予想される。したがって、それぞれの状況に備えた対策が急務である」と述べている。Counterpoint Researchの Global TV Shipments Quarterly Tracker によると、2024年の北米における先端技術TV市場では韓国企業が圧倒的な地位を占め、販売シェア53%を記録した。

[原文] Global Premium TV Market Grew 51% YoY in Q4 2024; Samsung Leads, TCL Surpasses LG to Take Second Spot

- Global TV shipments in Q4 2024 grew 2% YoY, the third consecutive quarters of YoY increases.

- Premium TV shipments grew 51% YoY, QD LCD and Mini LED LCD TVs continued to rise.

- TCL grew rapidly in the premium sector, surpassing LG to take 2nd place with 20% market share.

- Concerns about negative impact on TV makers with large sales of premium TVs in North America due to ‘Trump tariffs’.

Global TV shipments in Q4 2024 grew 2% YoY to reach 61 million units, according to the Global TV Shipments Quarterly Tracker released by Counterpoint Research recently. Annual TV shipments in 2024 reached 230 million units, also up 2% YoY. Most regions showed growth, but Japan and Asia showed a shrinking TV market, declining 15% and 4% YoY, respectively. Samsung maintained its top spot in the market with a 16% share in Q4 2024, but TCL was in hot pursuit of Samsung, taking second place with a 14% share. Hisense took third place with a 12% share while LG maintained its fourth place with a 10% share, similar to the same period last year.

Shipments of premium TV models, consisting of QD-MiniLED, QD-LCD, NanoCell, LCD 8K, QD-OLED, WOLED and MicroLED TVs, grew 51% YoY to reach a record high. For the full year 2024, the shipments were up 38% YoY.

As Chinese brands intensified their attacks on the premium market, which is expected to show high growth, Samsung's market share fell to 29%, down 12 percentage points YoY. On the other hand, TCL shipped more than twice as many premium TVs YoY, surpassing LG to take second place in the premium market.

In the premium TV market, shipments of MiniLED LCD TVs grew by more than 170% YoY, surpassing OLED TV shipments since the second quarter. QD-LCD TVs also grew by more than 46%, exceeding 5 million units for the first time in terms of quarterly shipments. Counterpoint Research researcher Calvin Lee said, “If the Trump administration’s ‘tariff bomb’ is implemented, Mexican-produced TVs will also be affected by the 25% tariff on Mexico. In particular, South Korean companies that account for a large portion of the North American premium TV market are expected to be affected more. Therefore, countermeasures are urgently needed to prepare for each situation.” According to Counterpoint Research’s Global TV Shipments Quarterly Tracker, South Korean companies held an overwhelming position in the North American premium TV market in 2024, recording a 53% share in terms of sales.