2023年のOLED出荷額は前年比9%減~IT分野とスマートフォンの回復は2024年も続く見通し

出典調査レポート Quarterly OLED Shipment Report の詳細仕様・販売価格・一部実データ付き商品サンプル・WEB無料ご試読は こちらから お問い合わせください。

これらDSCC Japan発の分析記事をいち早く無料配信するメールマガジンにぜひご登録ください。ご登録者様ならではの優先特典もご用意しています。【簡単ご登録は こちらから 】

冒頭部和訳

2023年のOLED出荷額が前年比9%減の376億ドルになる見通しだ。DSCCが Quarterly OLED Shipment Report 最新版で明らかにした。前回予測では前年比13%減の見通しだった。パネル出荷額見通しの引き上げは、2023年下半期に複数の用途で在庫状況と需要の改善が見られ、出荷数が前年比2%増となったことによる。DSCCのシニアディレクターであるDavid Naranjoは次のように述べている。「Q3’23はOLEDスマートフォンが前期比9%増、前年比22%増、OLEDタブレットが前期比61%増、前年比103%増となった。前期比、前年比ともに増加した用途は他にも複数見られた。これらの増加の結果、2023年下半期は前年比37%増となる見込みで、これは11%の引き上げとなる」

OLED Revenues to Decline 9% Y/Y in 2023 – Recovery in IT Categories and Smartphones Expected to Continue in 2024

※ご参考※ 無料翻訳ツール (DeepL)

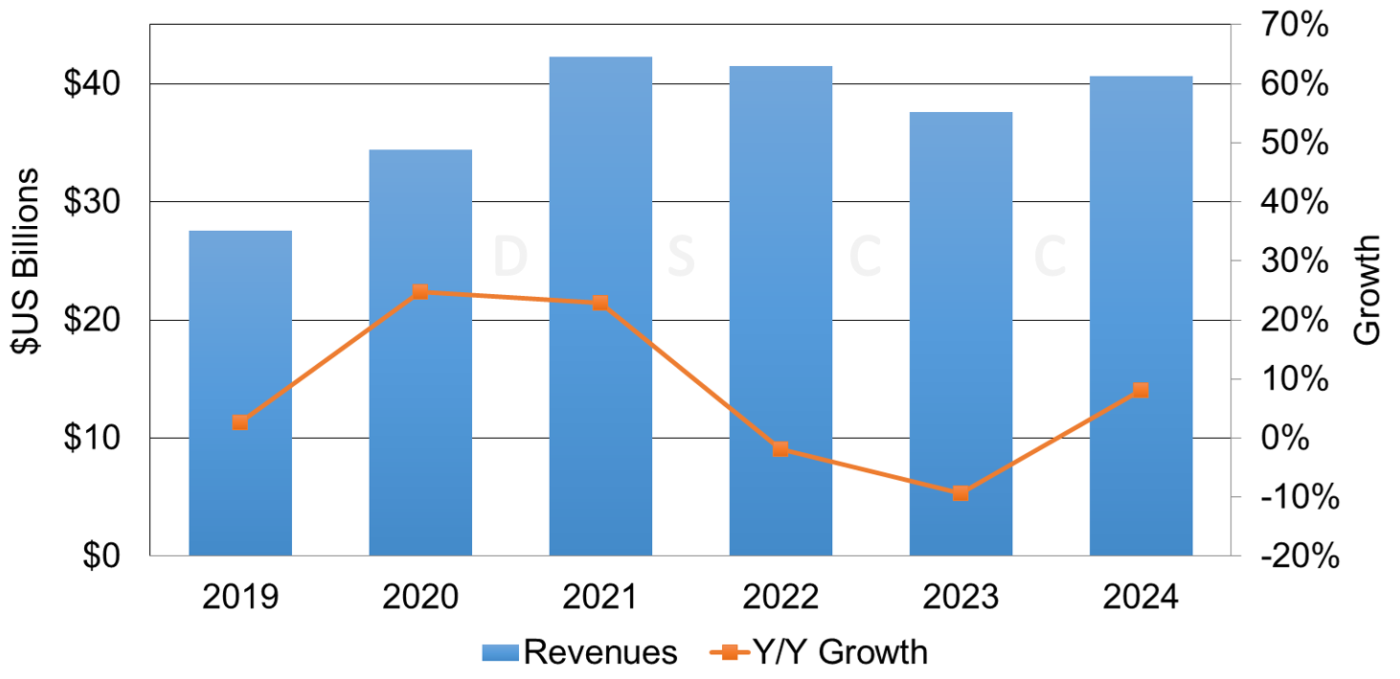

As revealed in DSCC’s latest release of the Quarterly OLED Shipment Report, OLED panel revenues are expected to fall by 9% Y/Y in 2023 to $37.6B versus our prior estimate of a 13% Y/Y decline. The improvement to panel revenues is the 2% Y/Y increase for units as a result of the 2H’23 inventory and demand improvement for several applications. According to DSCC Senior Director David Naranjo, "In Q3’23, OLED smartphones increased 9% Q/Q and 22% Y/Y and OLED tablets increased 61% Q/Q and 103% Y/Y. Several other applications had Q/Q and Y/Y increases. Please refer to the report for more details. As a result of the increases, 2H’23 is expected to be up 37% versus 2H’22, which was up 11%."

In 2023, by select OLED applications:

- We expect OLED smartphone units to increase 6% Y/Y and decline 9% Y/Y in revenues on 23% Y/Y unit increases for flexible and 46% Y/Y unit increases for foldable OLED smartphones with double-digit panel ASP declines;

- We expect OLED TVs to decline 29% Y/Y in units and 26% Y/Y in revenues;

- We expect OLED notebook PCs to decline 26% Y/Y in units and 33% Y/Y in revenues as a result of the 1H’23 inventory issues and macroeconomic environment. The 2H’23 has seen improvements as a result of the rebalancing of brand and channel inventories as well as increased demand from back-to-school and holiday seasonality. We show OLED notebook PCs tracking 61% higher in the 2H’23 versus the 1H’23.

We expect other OLED applications to have unit and revenue growth in 2023. These include AR/VR, automotive, monitors and tablets. In 2024, we expect 11% Y/Y unit and 8% Y/Y revenue growth, fueled by AR / VR with triple-digit Y/Y growth, IT applications with triple digit Y/Y growth for tablets as a result of Apple entering the OLED tablet category and double-digit Y/Y growth for monitors and notebook PCs. For OLED smartphones, we expect single-digit Y/Y growth fueled by growth for flexible and foldable OLED smartphones on lower panel ASPs. Further details can be found in the report.

AMOLED Panel Revenue and Y/Y Growth

In 2023, smartphones are expected to remain the dominant application with an 80% unit and 79% revenue share. OLED smartwatches are expected to remain the #2 application with a 14% unit share, down from 16% in 2022 and a 5% revenue share, down from 6% in 2022. In 2027, on a panel revenue basis, we expect OLED smartphones to decline to a 55% revenue share as a result of gains from OLED notebook PCs, monitors, tablets, AR/VR and automotive applications.

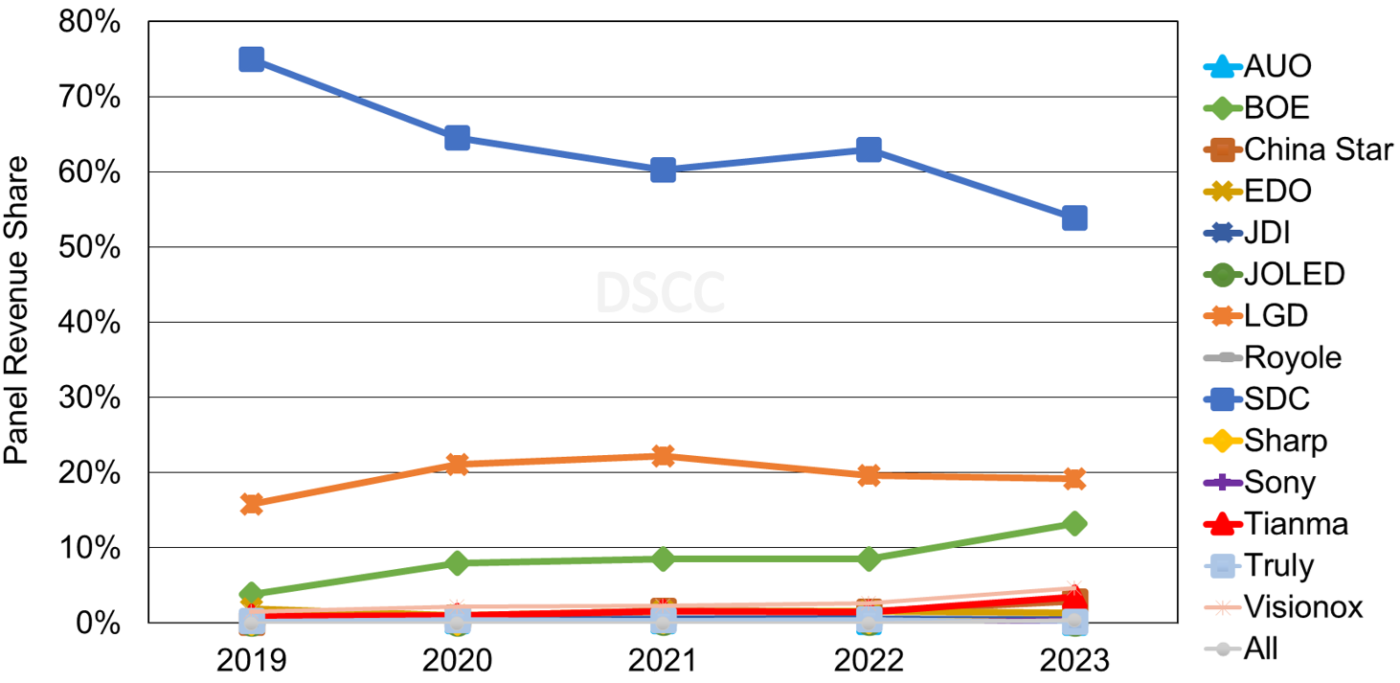

In 2023 for panel revenue by panel supplier for all applications:

- We expect SDC to have the majority panel revenue share as a result of triple-digit Y/Y growth for monitors and double-digit growth for automotive and tablets. As a result of SDC being the only panel supplier providing all four iPhone 15 panels in 2023, we expect SDC to have a 76% share of the iPhone 15 series panel shipments in 2023.

- We expect LGD’s revenue share to be 19%, down from 20% in 2022. LGD is the panel supplier for the iPhone 13, iPhone 13 Mini, iPhone 14, iPhone 14 Pro Max, iPhone 15 Pro and iPhone 15 Pro Max. We expect LGD to account for 22% of the iPhone 15 series panel shipments in 2023 as a result of LGD supplying panels for only the LTPO OLED panels for the iPhone 15 Pro and iPhone 15 Pro Max. LGD is also a key panel supplier for the growth areas of monitors and automotive applications. For OLED monitors, LGD is expected to have a 38% unit share, up from 34% in 2022 and a 33% revenue share, up from 30% in 2022. For OLED TVs, LGD is expected to have an 82% unit share and 76% revenue share.

- We expect BOE to be the #3 panel supplier with a 13% revenue share in 2023, up from 9% in 2022. The increase in panel revenue share is the result of a 47% Y/Y unit increase for smartphones and triple-digit growth for automotive applications. For Apple OLED smartphones, BOE provides panels for the iPhone 12, iPhone 13, iPhone 14 and supplies panels for the iPhone 15 and iPhone 15 Plus. In 2023, BOE is expected to have a 16% share of iPhone panel shipments, up from 14% in 2022.

AMOLED Panel Revenue Share by Panel Supplier

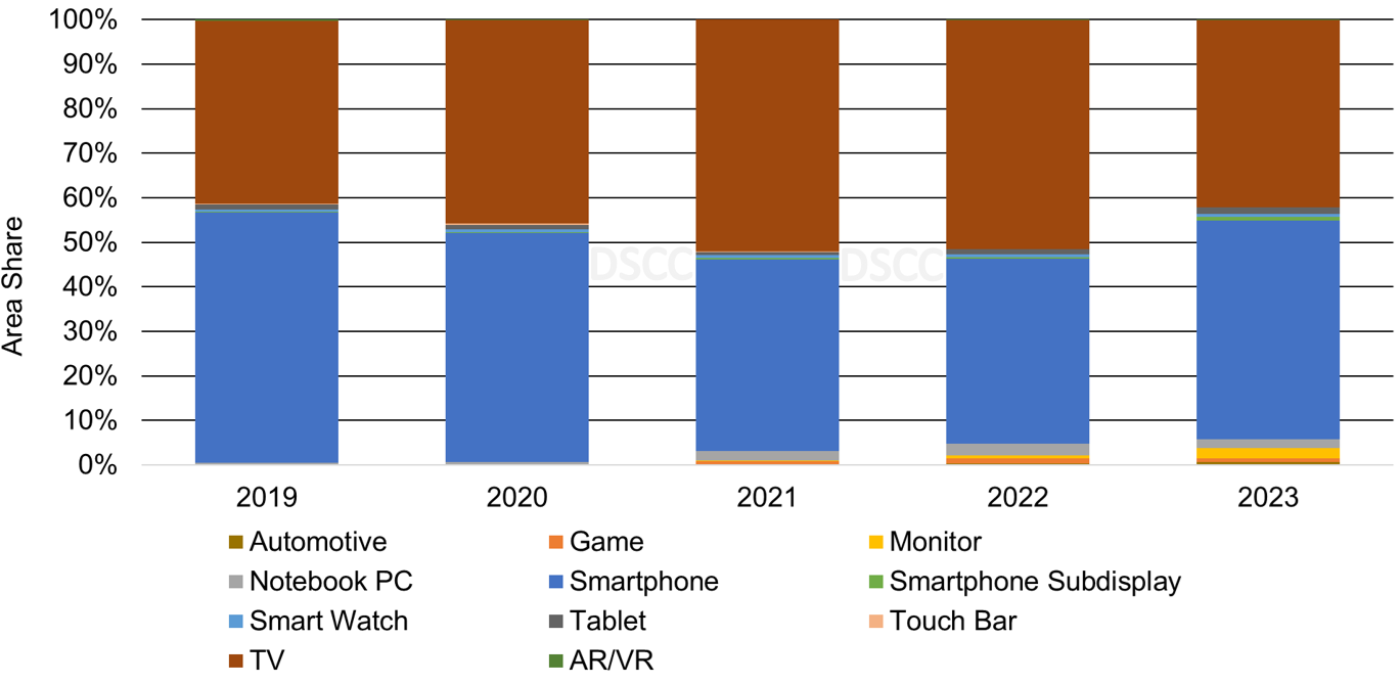

On an area basis, OLED TVs are expected to have a 42% area share in 2023, down from 51% in 2022 as a result of gains from smartphones, tablets, automotive applications and monitors. In 2023, we expect OLED smartphones to grow to a 48% area share, up from 42% in 2022 as a result of a 43% Y/Y unit increase for the 6.6” to 8” category.

Annual OLED Area Share by Application

出典調査レポート Quarterly OLED Shipment Report の詳細仕様・販売価格・一部実データ付き商品サンプル・WEB無料ご試読は こちらから お問い合わせください。