Advanced (先端技術FPD搭載) タブレット用FPD市場~Q2’24はOLED出荷数急増、2024年出荷数は前年比3倍以上の1400万枚超へ

出典調査レポート Quarterly Advanced IT Display Shipment and Technology Report の詳細仕様・販売価格・一部実データ付き商品サンプル・WEBご試読は こちらから お問い合わせください。

これらDSCC Japan発の分析記事をいち早く無料配信するメールマガジンにぜひご登録ください。ご登録者様ならではの優先特典もご用意しています。【簡単ご登録は こちらから 】

冒頭部和訳

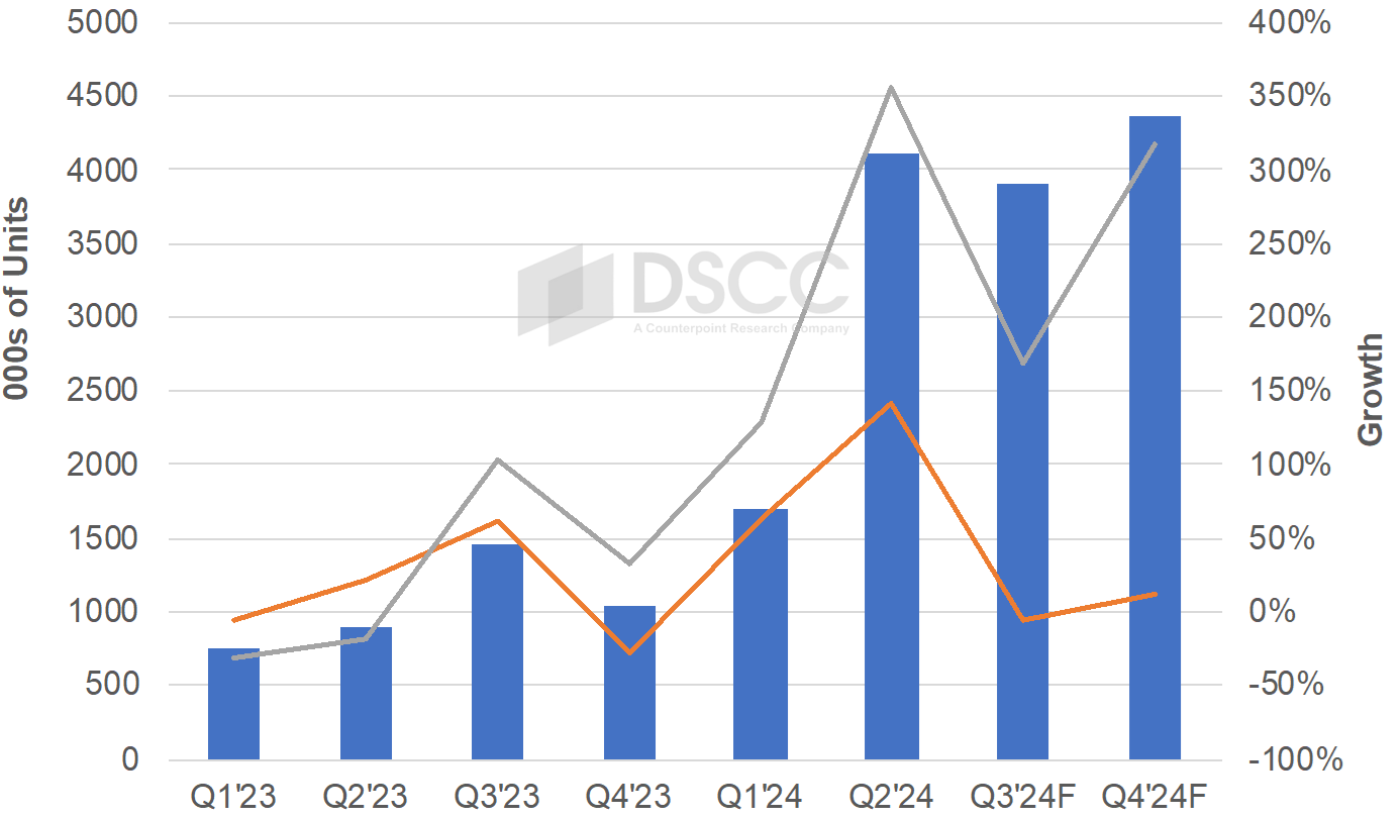

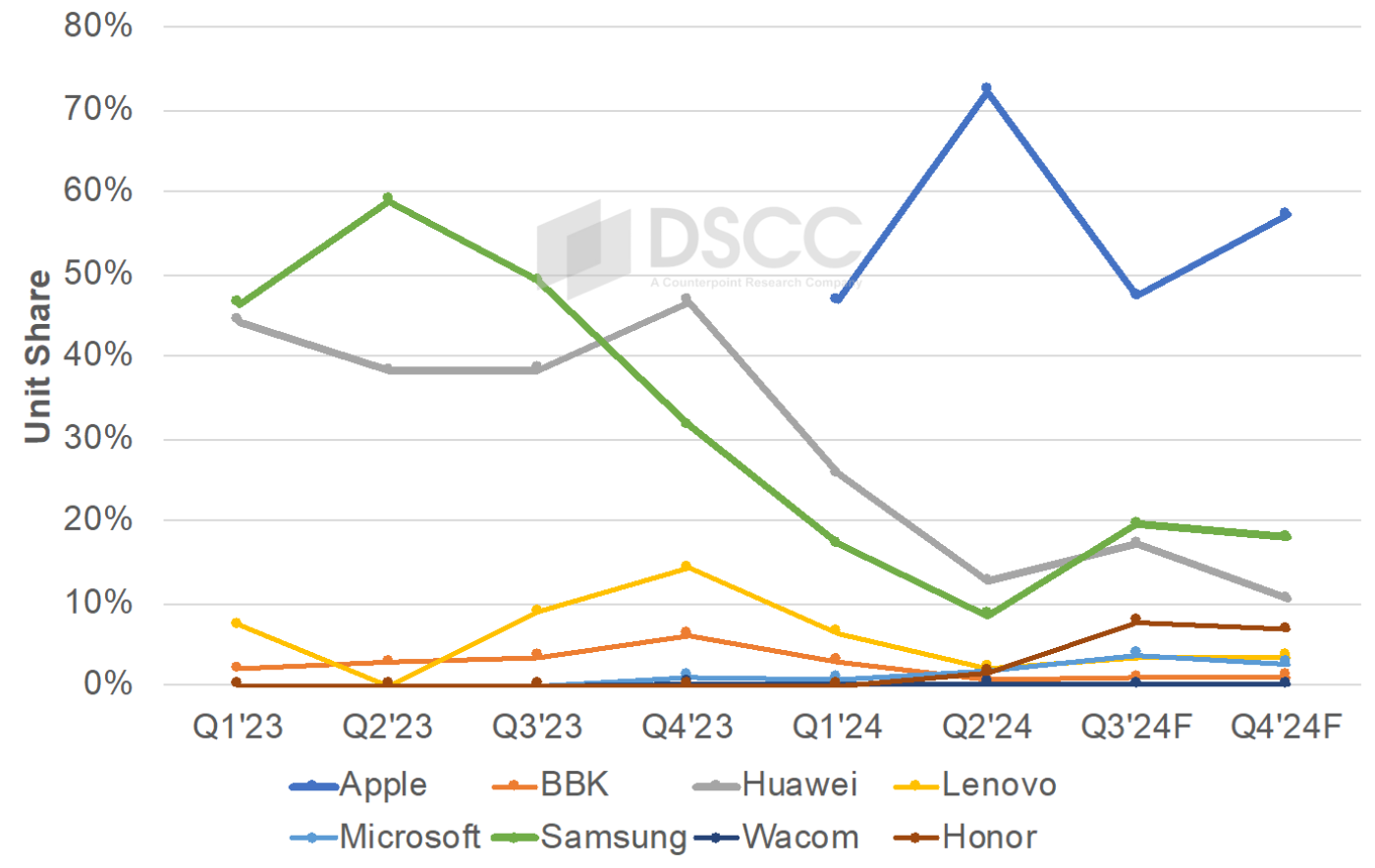

- Q2’24のタブレット用OLED出荷数は過去最高の410万枚となった。Appleが待望の11.1インチおよび13インチ OLED iPad Proを発売したことが要因。Q2’24のタブレット用OLED市場はAppleが調達シェア72%を獲得、Huaweiが13%、Samsungが9%で続いた。

- 調達数ベースでは13インチOLED iPad Proが11.1インチOLED iPad Proをわずかに上回り、2四半期連続で市場をリードした。両モデルに続くのはHuaweiの13.2インチMate Pad Proだが、シェアはわずか5%だった。パネルメーカー別ではLG DisplayとSamsung Displayがそれぞれシェア41%を獲得しQ2'24市場を二分した。

- Q3'24のタブレット用OLED出荷数は前期比5%減、前年比169%増の約390万枚と予測される。Q2'24に好調だったAppleは大幅に落ち込むが、新規参入のHonorとMicrosoft、および既存プレーヤーであるHuasei、Lenovo、Samsungの出荷数増加によってほぼ相殺される見通しだ。SamsungではQ4'24発売予定のGalaxy Tab S10 PlusおよびS10 Ultra向けにパネル生産をQ3'24に増やすと見られる。

Q2’24のタブレット用OLED出荷数は前期比142%増、前年比356%増の411万枚となり、過去最高を記録した。Appleがタブレット業界で初めてタンデムOLEDスタックパネルを搭載、これまで生産されたタブレットのなかで最も薄い、待望の11.1インチおよび13インチiPad Proを発売したことが要因である。Q2’24のタブレット用OLED市場はAppleがシェア72%を獲得、Huaweiが13%、Samsungが9%で続いた。調達数ベースでは13インチOLED iPad Proが11.1インチOLED iPad Proをわずかに上回って2四半期連続で市場をリードした。Q2’24の両モデルのシェアは36%だった。第3位のモデルはHuaweiの13.2インチMate Pad Proでシェア5%だった。パネルメーカー別ではLG DisplayとSamsung Displayがそれぞれシェア41%を獲得しQ2'24市場を二分した。

OLED Tablet Panel Shipments Surge in Q2’24, 2024 Volumes Expected to More than Triple to Over 14M Panels

- OLED tablet panel shipments reached a new record high in Q2’24 to 4.1M as Apple launched its highly anticipated 11.1” and 13” OLED iPad Pro’s. Apple dominated the OLED tablet panel market in Q2’24 with a 72% share followed by Huawei at 13% and Samsung at 9%.

- The 13” OLED iPad Pro led the market on a panel procurement basis for the second straight quarter with a slight edge over the 11.1” OLED iPad Pro followed by the Huawei Mate Pad Pro 13.2” with just a 5% share. LG Display and Samsung Display split the Q2’24 market on a panel supplier basis with a 41% share each.

- In Q3’24, OLED tablet panel growth is expected to fall 5% Q/Q while rising 169% Y/Y at nearly 3.9M panels. A sizeable drop at Apple after a robust Q2’24 is expected to be nearly offset by gains at new entrants Honor and Microsoft and from higher volumes at existing players Huawei, Lenovo and Samsung with Samsung ramping panel production in Q3’24 for the upcoming Galaxy Tab S10 Plus and S10 Ultra to be launched in Q4’24.

OLED tablet panel shipments rose 142% Q/Q and 356% Y/Y in Q2’24 to a record high 4.11M as Apple launched its highly anticipated 11.1” and 13” iPad Pro’s which feature the tablet industry’s first tandem OLED stack panels along with the thinnest tablets produced to date. Apple dominated the OLED tablet panel market in Q2’24 with a 72% share followed by Huawei at 13% and Samsung at 9%. The 13” OLED iPad Pro led the market on a panel procurement basis for the second straight quarter with a slight edge over the 11.1” OLED iPad Pro. Each model had a 36% share in Q2’24. The #3 model on a panel procurement basis was the Huawei Mate Pad Pro 13.2” at 5%. LG Display and Samsung Display split the Q2’24 market on a panel supplier basis with a 41% share each.

In Q3’24, OLED tablet panel growth is expected to pause sequentially, falling 5% Q/Q, but rising 169% Y/Y at nearly 3.9M panels. A sizeable drop at Apple is expected to be nearly offset by gains at new entrants Honor and Microsoft and from higher volumes at existing players Huawei, Lenovo and Samsung. Huawei recently launched the first tandem stack OLED tablet outside of Apple and Samsung’s volume should more than double Q/Q as it prepares to launch the Galaxy Tab S10 Plus and S10 Ultra. Apple’s share is expected to fall to 47% with Samsung’s share rising to 20% and Huawei’s share rising to 17%. The 11.1” OLED iPad Pro is expected to be the #1 OLED tablet on a panel procurement basis in Q3’24 with a slight 24% to 23% advantage over the 13” iPad Pro with the new Honor Magic Pad2 slipping into the #3 spot. Samsung Display is expected to lead the Q3’24 market on a panel supplier basis with a 46% share followed by LG Display at 25% and EDO at 23%. 19 OLED tablet models are expected to purchase panels in Q3’24 vs. 10 in Q3’23.

According to DSCC CEO Ross Young, “2024 will likely be the year of the OLED tablet with over 200% growth projected to over 14M OLED tablet panels. OLED tablet panels are seeing significant improvements in availability, performance, cost/price, form factors, size and more. Users are demanding the same excellent display performance found in smartphones and panel suppliers are now delivering the same impressive display experience to the tablet market. OLED tablets are now available with rigid, hybrid or flexible form factors. Weight and thickness are being significantly reduced as the top glass has been eliminated on flexible and hybrid models and the bottom glass is being thinned in some models. Brightness, power efficiency and lifetime have been improved with tandem stacks. In addition, while only two suppliers delivered OLED tablet panels in 1H’23, five different panel suppliers delivered panels in 1H’24. It is exciting to see such growth.”

For more information on DSCC’s OLED tablet reporting, please see its Quarterly Advanced IT Display Shipment and Technology Report.

出典調査レポート Quarterly Advanced IT Display Shipment and Technology Report の詳細仕様・販売価格・一部実データ付き商品サンプル・WEBご試読は こちらから お問い合わせください。