Q3’24のFPDメーカー業績プレビュー

これらDSCC Japan発の分析記事をいち早く無料配信するメールマガジンにぜひご登録ください。ご登録者様ならではの優先特典もご用意しています。【簡単ご登録は こちらから 】

Q3’24のFPDメーカー業績プレビュー ※日本時間10月22日未明

10月23日 (水) のLG Displayを皮切りに、AUOやSamsungなどFPDメーカー各社が順次、第3四半期決算発表を行う。中国のFPDメーカーの場合、第3四半期報告は例年10月31日前後に発表される決算短信によるものとなる。本稿ではFPDメーカー各社の業績のプレビューを行う。

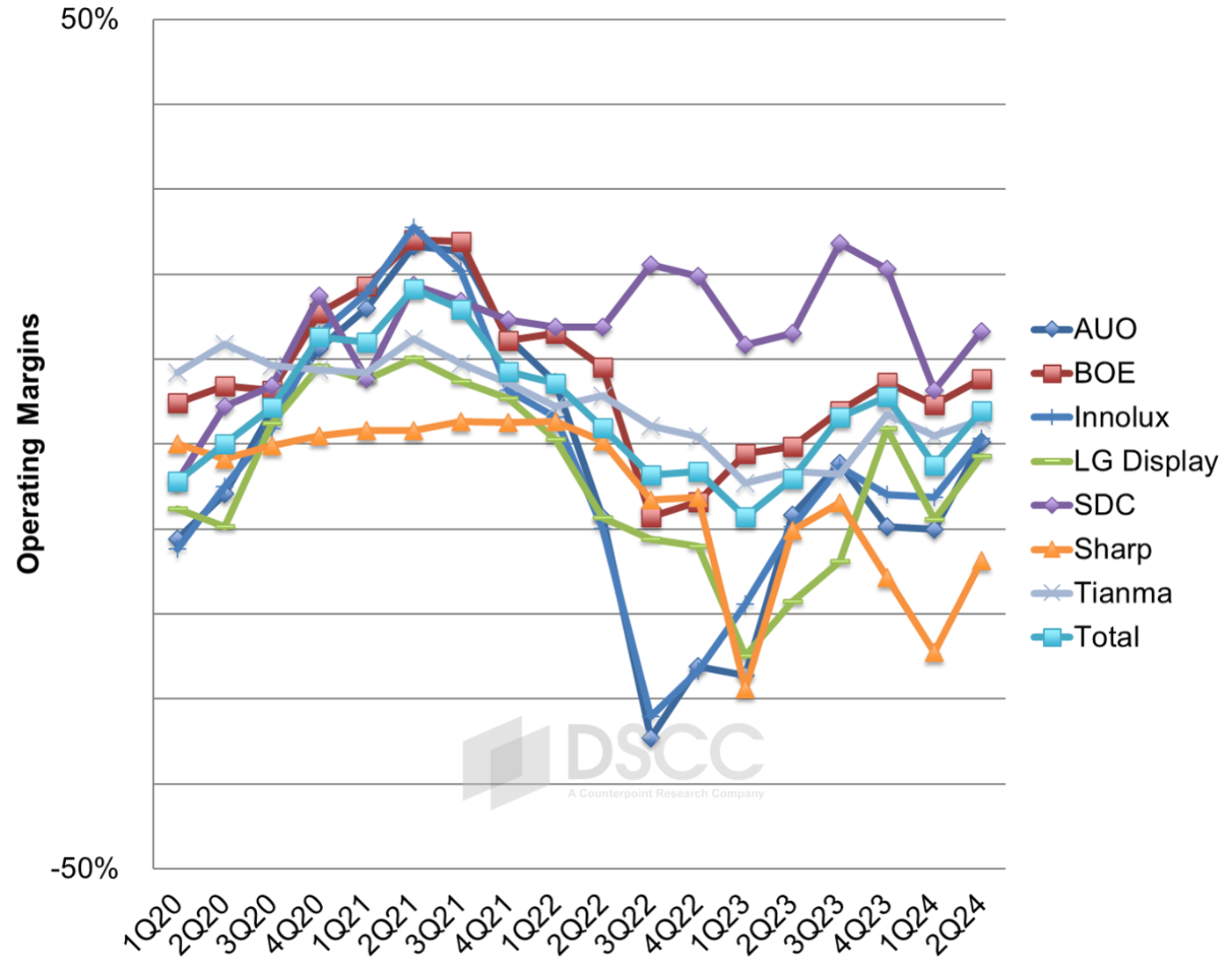

まず、FPD業界の営業利益率について概要を説明する。以下のグラフは2020年以降の業界大手の営業利益率を示している。クリスタルサイクル後の2020年から2021年にかけて、営業利益率はタイトなレンジで推移している一方、FPDメーカー間で業績の乖離が拡大していることがわかる。

- SDCはプラスの営業利益率を維持しており、2022年6月にLCD生産を終了したため、以降はLCD価格下落の影響を受けずにいる。Q1’24は季節要因によるスマートフォン用パネル出荷減少が平均より大きかったことで営業利益率が大きく低下したものの、Q2’24には2桁%の範疇に回復した。

- AUO、Innolux、LGDの各社はクリスタルサイクルの影響を受けやすく、Q2’24はLCD価格の上昇によって営業利益率が改善した。

BOEはQ2’24に営業利益を計上、これは4四半期連続で、常に台湾の競合他社よりも高い利益率を維持している。

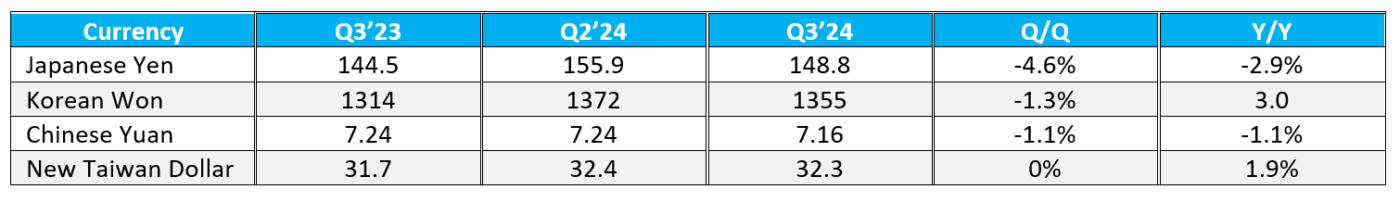

以下の表に示すように、新台湾ドル以外のアジア通貨がすべて強含みで推移したため、為替効果は第3四半期利益率にマイナスの影響を与えた可能性が高い。パネル販売は通常米ドル建てで行われるため、通貨高は現地通貨建てによる収益の減少を意味する。

7月のガイダンスだが、FPDメーカー各社は第3四半期について慎重姿勢を示していた。

- LGDは出荷面積が前期比1桁台半ばの増加、ASPが前期比横ばいと予想していた。

- AUOは3つの事業セグメントについてガイダンスを発表した。全体的な収益ガイダンスは示されなかったが、事業セグメントのガイダンスでは収益が前期比横ばいから若干減少と示唆されていた。

- Innoluxは大型パネル出荷数が前期比1桁台前半の減少、中小型パネル出荷数が前期比1桁台前半の増加、加重ASPが前期比横ばいと予想していた。

月次収益報告によると、Innoluxの大型パネル出荷数は前期比2%減と予想通りだったが、小型パネル出荷数は6%減でガイダンスはかなり楽観的だったと言える。Innoluxの収益は前期比3%減だったため、全体としてはガイダンスに近いと思われる。AUOの収益は前期比5%増でガイダンスを上回ったようだ。

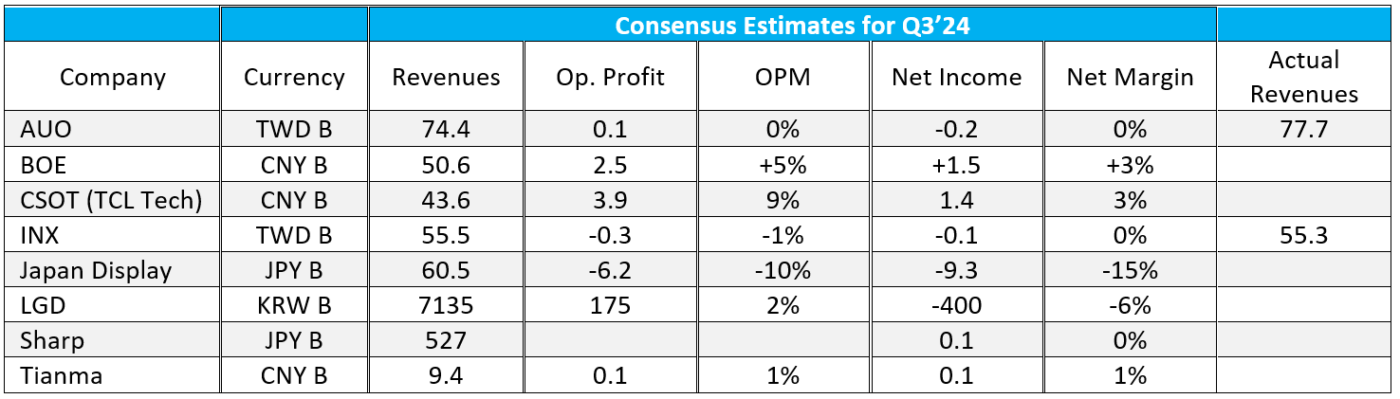

以下の表は、marketscreener.comによるFPDメーカー各社Q3'24業績のアナリスト予想である。アナリストの利益率予想では、Q3'24の利益率は前期比で改善が見込まれている。AUOの収益はアナリスト予想を9%上回ったため、営業利益率も上回る可能性が高い。Innoluxの収益は予想通りだったため、営業利益と純利益も予想通りになりそうだ。

LGDのガイダンスは前期比で約5%の増収 (韓国ウォンベース) を示唆、コンセンサス予想は6%の増収を見込んでいることから、LGDがガイダンスを達成すればコンセンサス予想に近くなる。

重要視されるのはおそらく、決算発表内容よりもQ4’24に関するガイダンスのほうだろう。LCD価格は第3四半期にかけて下落してきたが第4四半期には安定し、最近発表された中国の景気刺激策もあり、FPDメーカー各社のガイダンスは慎重ながらも楽観的なものになると予想される。

[原文] Panel Maker Q3’24 Earnings Preview

LG Display will kick off the Q3 earnings season with a report on Wednesday, October 23rd, to be followed by AUO, Samsung and the rest of the flat panel display makers. For Chinese panel makers, the Q3 report will be an abbreviated report, which usually is issued about October 31st. Let’s preview the panel maker earnings season.

First, let’s set the stage with an overview of operating margins in the industry. The chart here shows the operating margins of the larger companies in the industry since 2020. While operating margins held in a tight range in 2020-2021 following the Crystal Cycle, we see an increasing divergence of performance among panel makers.

- SDC has continued to report positive operating margins and SDC is now immune to declines in LCD panel prices since it stopped all production of LCD in June 2022. SDC saw its operating margin drop precipitously in Q1’24 on a larger-than-average seasonal slowdown in smartphone panel shipments but recovered into the double-digit % category in Q2’24.

- AUO, Innolux and LGD have been more sensitive to the cycle and saw margins improve in Q2’24 with higher LCD panel prices.

- BOE reported its fourth consecutive quarter of operating profits in Q2’24 and BOE consistently sustains margins higher than its competitors in Taiwan.

Currency effects likely had a negative impact on margins in the third quarter, as all the Asian currencies except the new Taiwan dollar strengthened, as shown by the table below. The stronger currency means that revenues from panel sales, which are usually made in US dollars, will translate to lower revenues in the local currency.

In terms of guidance, in July these companies were cautious about Q3:

- LGD expected area shipments to increase by a mid-single-digit % Q/Q and for ASPs to be flat Q/Q.

- AUO gave guidance for its three business segments. Although the company did not give overall revenue guidance, the business segment guidance implied Q/Q revenues to be flat to down slightly.

- Innolux expected large panel shipments to be down by a low single-digit % Q/Q, small/medium panel shipments to be up by a low single-digit % Q/Q and blended ASP to be flat Q/Q.

Based on monthly revenue reports, Innolux was right in line concerning large area shipments, which were down 2% Q/Q, but too optimistic about small panel shipments which were down 6%. Overall, the company seemed to be close to its guidance as Innolux revenues were down 3% Q/Q. AUO revenues, which were up 5% Q/Q seemed to be better than its guidance.

The table below shows analyst expectations for Q3’24 for the panel makers with analyst coverage, according to marketscreener.com. The analyst expectations for margins anticipate a sequential improvement in margins in Q3’24. AUO revenues were 9% higher than analyst expectations so AUO is likely to do better on operating margin as well. Innolux revenues were right in line with expectations, so operating profit and net income are likely to be in line with expectations as well.

LGD’s guidance implies an increase in revenues (in KRW) of about 5% and consensus estimates predict a revenue increase of 6% Q/Q, so if LGD meets its guidance it will come close to meeting consensus expectations.

Perhaps more important than the results will be the guidance given about Q4’24. With LCD panel prices falling through Q3 but stabilizing in Q4, and with the recently announced stimulus package in China, we expect panel makers to be cautiously optimistic in their guidance.