Q2'24の世界FPDメーカー業績レビュー~業界の健全化に向け前進

これらDSCC Japan発の分析記事をいち早く無料配信するメールマガジンにぜひご登録ください。ご登録者様ならではの優先特典もご用意しています。【簡単ご登録は こちらから 】

冒頭部和訳

DSCCの Quarterly Display Supply Chain Financial Health Report (※商品紹介ページはありません) は上場FPDメーカー13社を追跡しており、企業の財務情報開示に基づいている。Q2'24は業界のほぼすべての企業で財務状況が改善した。大型LCDに重点を置くFPDメーカーはパネル価格上昇と需要増の恩恵を受けた一方、スマートフォン向けの小型ディスプレイに重点を置く複数の企業が損失を削減した。

Q2’24 Flat Panel Display Financials Show Progress Toward a Healthy Display Industry

DSCC’s Quarterly Display Supply Chain Financial Health Report covers the 13 publicly traded panel makers and is based on company financial disclosures. In the second quarter of 2024, nearly every company in the industry improved its financial position. Companies focusing on large-area LCD displays benefitted from rising panel prices and strong demand, while several companies focused on smaller displays for smartphones trimmed their losses.

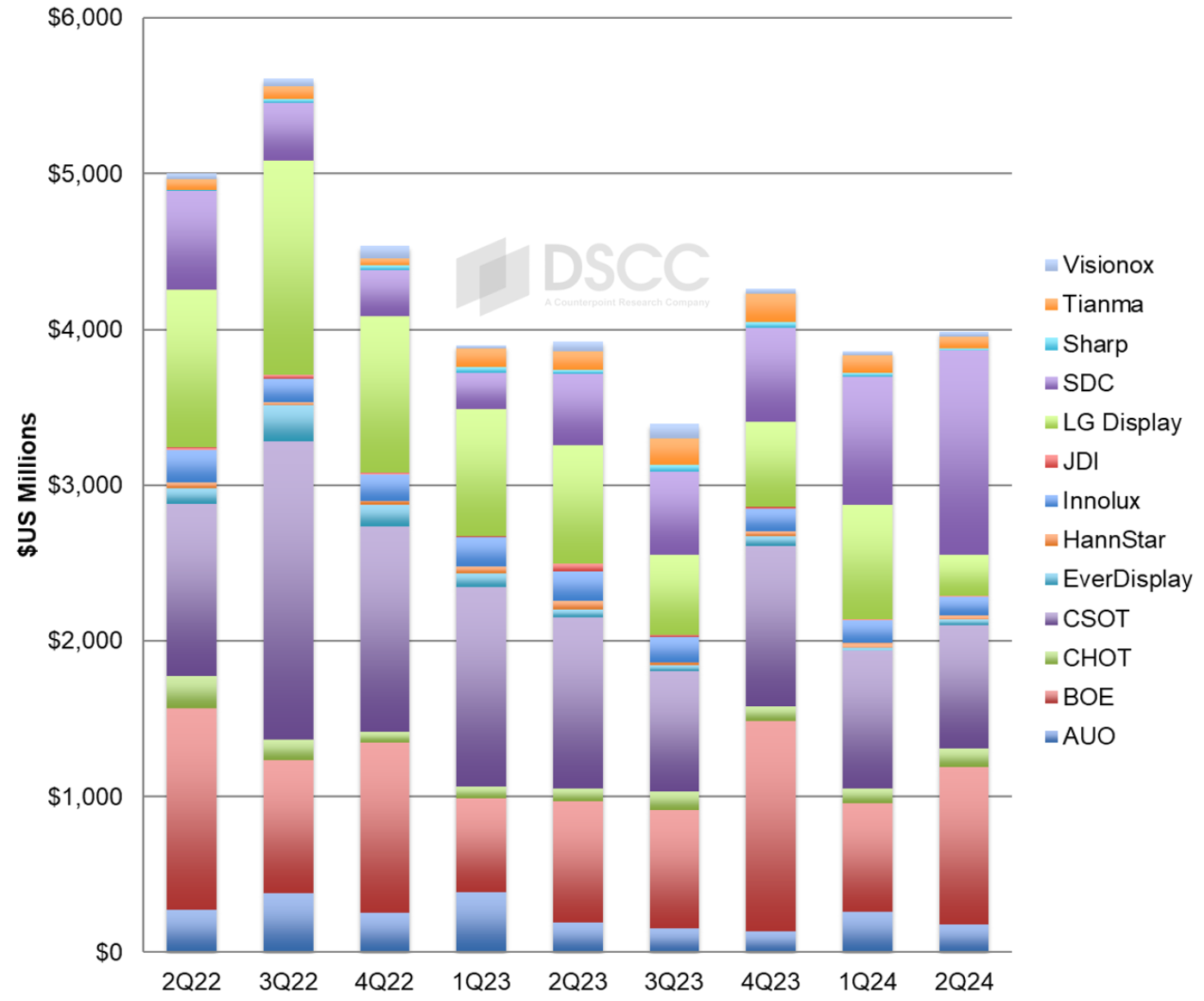

After a seasonal slowdown in Q1, total revenues rebounded in Q2, increasing by 12% Q/Q and by 10% Y/Y to $26.2B. Ten of the 13 panel makers had sequential revenue increases, and nine companies had Y/Y increases. Samsung Display revenues increased 38% Q/Q while BOE revenues increased only 2% Q/Q, so SDC regained the #1 spot in FPD revenues ahead of BOE.

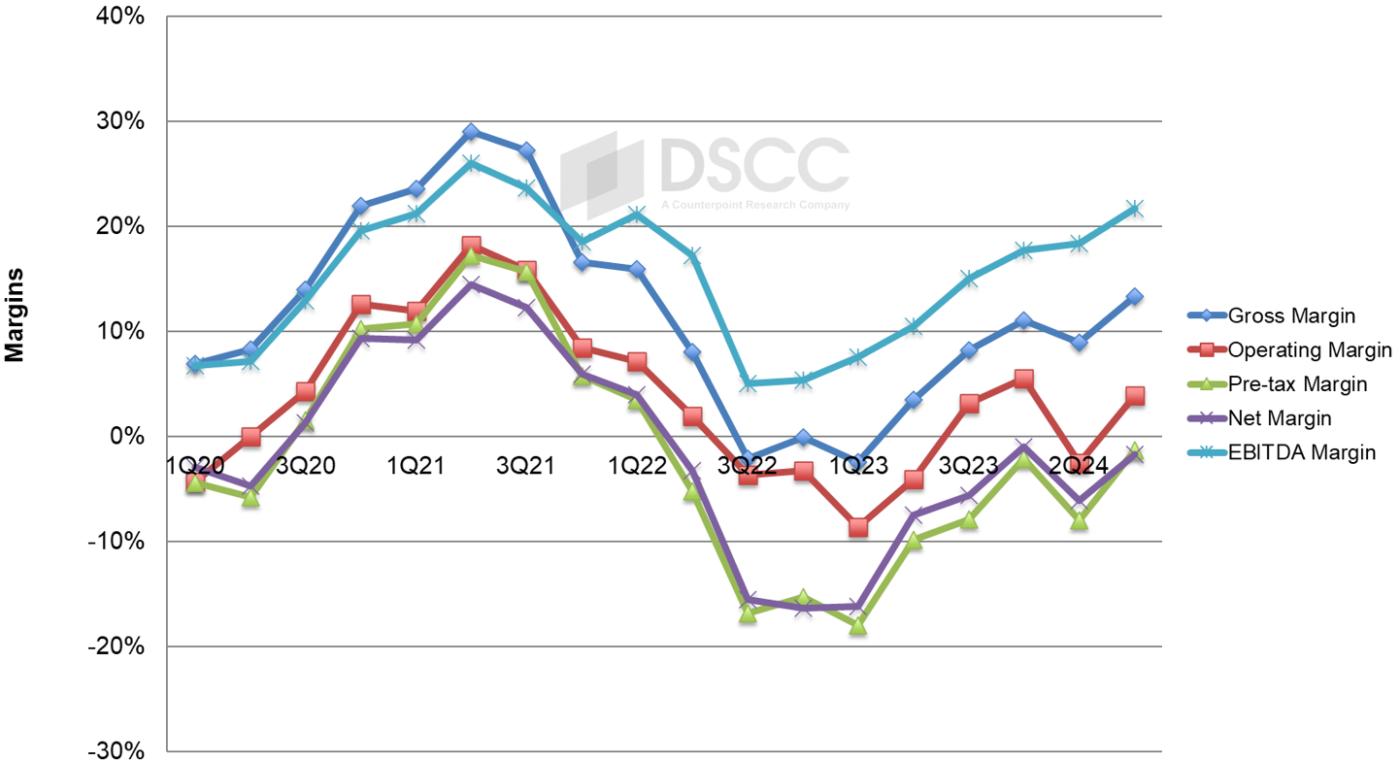

The pandemic-fueled upcycle peaked in Q2 2021, and the industry bottomed out between Q3 2022 and Q1 2023. Margins improved in each quarter of 2023 after Q1 and resumed their positive trend in Q2’24 after a seasonal pause in Q1. The net margin of the industry remained under water for the ninth consecutive quarter.

The flat panel display industry as a whole totaled an operating profit of nearly $900M, an improvement of nearly $1.3 billion compared to Q1, and six of the twelve panel makers reported operating profits in Q2’24. Samsung’s $736M operating profit gobbled up almost all the industry’s gain, and excluding SDC and BOE, total industry operating results were a loss of more than $300M.

Most companies in the industry improved their operating margins sequentially in Q2’24, with the exceptions coming from the two companies outside China which focus on smaller screen displays – HannStar and Japan Display. HannStar’s results were the worst in more than ten years and perhaps the worst ever for the Taiwanese niche player.

Among the eleven companies that report net results, seven reported a net loss in Q2’24, with only BOE, CSOT, CHOT and Innolux reporting net profits. The industry in total lost $275M in the second quarter, the ninth consecutive quarter of net losses. On the positive side, the industry’s total net loss was smaller Q/Q by $635M and smaller Y/Y by $1.9B.

EBITDA for the industry increased by 30% Q/Q and by 131% Y/Y to $3.6B. As in operating profits, EBITDA results improved for most companies in the industry, with the exceptions mainly among companies focused on smaller screens – HannStar and Japan Display.

Inventories edged up by 1% sequentially in Q2’24 and remain well below the levels that characterized the post-pandemic industry slump. Inventory days were flat Q/Q at 65.

Operating cash flow improved for seven of the ten companies that report display segment results. The industry total for the quarter decreased by 5% Q/Q but increased by 27% Y/Y to $2.3B. LGD’s cash flow improved by more than $800M Q/Q from a negative $260M in Q1’24 to a positive $578M in Q2’24, helped by reduced working capital and restrained capital expenditures.

Capex for these thirteen panel makers increased by 3% Q/Q and by 2% Y/Y to $4.0B, and the running 12-month total of $15.5B was at its lowest level since 2016. SDC led display industry capex with $1.3B followed by BOE with $1.0B.

The industry saw its best-ever upswing of the Crystal Cycle in 2020-2021 and its worst-ever downswing in 2022-2023. The recovery in 2023 centered on companies which concentrate on LCD panels for large-area applications, including the Taiwan panel makers but also CHOT, BOE and CSOT in China. The 2023 recovery was not strong enough to bring the Taiwanese panel makers into the black, and the industry took a step backward in Q1’24, but took another step forward in Q2’24. With LCD panel prices decreasing in Q2’24, we are likely to see that operating results for LCD makers degrade in the third quarter.