UDCの第3四半期決算~黒字計上も材料販売減速を示唆

関連調査レポート Biannual AMOLED Materials Report の詳細仕様・販売価格・一部実データ付き商品サンプル・WEB無料ご試読は こちらから お問い合わせください。

これらDSCC Japan発の分析記事をいち早く無料配信するメールマガジンにぜひご登録ください。ご登録者様ならではの優先特典もご用意しています。【簡単ご登録は こちらから 】

冒頭部和訳

2024年上半期の好業績を経て、Universal Display Corporation (UDC) が純利益の連続増益を報告した。一方で、材料販売は第3四半期末頃から減速するとの見通しを示した。 同社は現在、第4四半期の材料販売の減少を予想しており、2024年売上高予測を下方修正した。投資家らは決算説明会後に同社を非難し、木曜日の取引で同社の株価は11%下落した。11月1日 (金) の終値は180.25ドルで、年初来では3%の下落となった。

UDCの発表によると、Q3’24実績は売上高1億6200万ドルに対し純利益は6690万ドルだった。売上高はアナリストのコンセンサス予想である1億6500万ドルを2%下回ったものの、純利益はコンセンサス予想の5720万ドルを17%上回った。売上高は前期比2%増、前年比15%増で、純利益は前期比28%増、前年比30%増だった。

UDC Books a Profitable Q3 But Signals Material Sales Slowdown

After a strong first half of 2024, Universal Display Corporation (UDC) reported a sequential increase in net profits but signaled a slowdown in materials sales that started near the end of the third quarter. The company now projects reduced material sales in the fourth quarter and has downwardly revised its full year revenue guidance. Investors punished the company after the call, pushing the company’s stock price down 11% in trading on Thursday. The company’s stock closed on Friday, November 1st at $180.25, down 3% year-to-date.

In its earnings release, UDC reported net income of $66.9M on revenues of $162M for Q3’24. Revenues were 2% lower than analysts’ consensus expectations of $165M but net income was 17% higher than consensus expectations of $57.2M. Revenues increased 2% Q/Q and 15% Y/Y, while net income increased 28% Q/Q and 30% Y/Y.

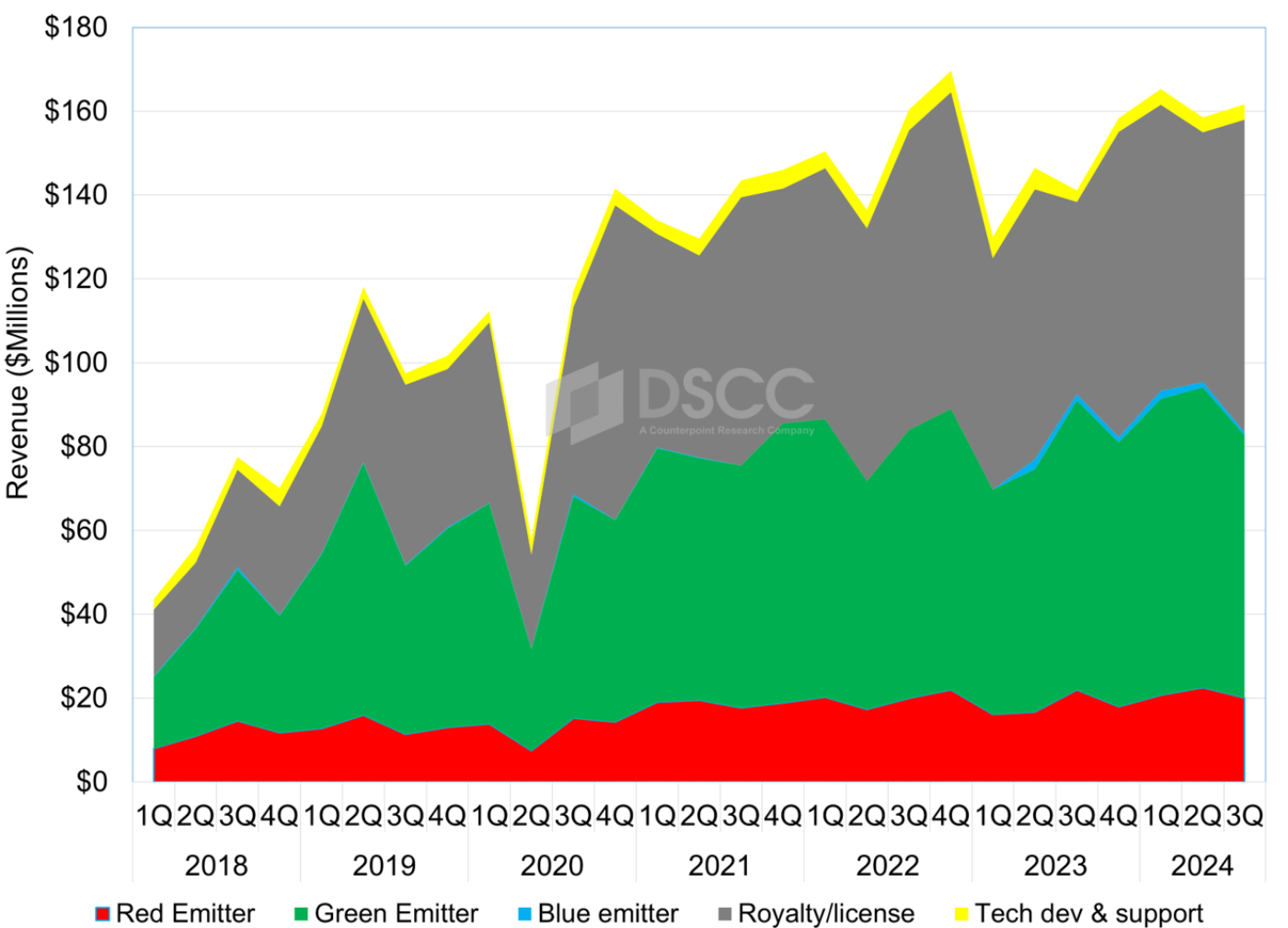

UDC sold $83.4M in materials in the second quarter, a decrease of 13% Q/Q and 10% Y/Y. UDC realized $74.6M in revenue from royalties and licensing, up 25% Q/Q and 62% Y/Y. The ratio of material sales revenue to licensing revenue for the quarter was 1.12, much lower than the ratio for the first half of 1.48. Earlier in the year, UDC’s guidance for the year said the ratio would be about 1.5, but UDC reduced the guidance to 1.4 in the October call.

UDC’s Korea revenues decreased 12% Q/Q but increased 9% Y/Y, while China revenues increased 36% Q/Q and 26% Y/Y. UDC recognizes material sales to LGD’s OLED TV plant in Guangzhou, China, as China revenues.

In its material sales, revenues from green emitter sales were down 13% Q/Q and 9% Y/Y at $62M, while revenues from red emitter sales were down 11% Q/Q and 9% Y/Y to $20M. The balance of $728K in material revenue came from blue emitter sales, down 46% from $1.3M in the prior quarter. UDC has reiterated that because it was in the development phase, blue revenues are likely to be volatile.

UDC updated its guidance for 2024, changing its guidance for full year revenues from a range of $645M-$675M to a range of $625M to $645M. The lower end of the range was $625M in February, was raised to $645M in August and now returns to its original value but the upper end of the range is now reduced. The revised guidance implies revenue growth of 9%-12% from 2023. As mentioned above, UDC also revised its guidance for the ratio of material sales to royalties, from 1.5 to 1.4. The rest of UDC’s guidance as released in February, remained unchanged:

- Overall gross margins in the range of 76%-77%;

- Aggregate operating expenses to increase at the high end of the previously guided range of 10%-15%;

- Operating margins in the range of 35%-40%;

- An effective tax rate of 20%.

The midpoint of UDC’s guidance implies operating income of $252M, which would be up 16% Y/Y. UDC has been reporting about $10M in net interest income each quarter in 2024, and assuming this extends to Q4, the guidance implies a net income of $211M, up 4% Y/Y. The revenue guidance and split imply Q4 material sales of $90M and Q4 royalties of $57M.

UDC repeated its statement on phosphorescent blue given in August, that they expected to achieve the milestone of a commercially acceptable blue in some months after the beginning of 2025. As we noted in August, UDC’s delay is consistent with the scenario described in DSCC’s Biannual AMOLED Materials Report. As the report’s author Kyle Jang has stated in the report, there remains a lifespan issue for phosphorescent blue, which is expected to delay the introduction to the end of 2025.

In other notes on the earnings call:

- UDC indicated that the slowdown in orders from its customers, which started near the end of Q3, was broad based across the customer groups.

- UDC declined to comment on an outlook for 2025.

- UDC declined to give a timetable for the growth in revenues for phosphorescent blue after it achieves the milestone.

関連調査レポート Biannual AMOLED Materials Report の詳細仕様・販売価格・一部実データ付き商品サンプル・WEB無料ご試読は こちらから お問い合わせください。